Forget Crowdfunding, Get a Peer Loan Instead!

Crowdfunding is just one side of the alternative finance coin. Is a peer loan a better option for your funding need?

Crowdfunding is changing the way people raise money for their dream projects and business ideas but is it the best form of financing available? Massive growth in peer lending last year brought the industry mainstream and may be a better option for your needs.

Peer lending is the marriage of personal credit and the internet revolution. From crowdfunding loans on peer-to-peer sites to consolidating your debt with websites like PersonalLoans.com, p2p lending is replacing banks as the top source for personal loans.

I’ve used PersonalLoans.com for a debt consolidation loan as well as a home improvement loan. Each time, I was able to pay the loan off early to save on interest. A five-minute application on the peer loan sites can get you up to $35,000 on a three- to five-year loan at rates comparable to traditional bank loans.

The difference in peer lending is that your loan request goes on the website directly to investors. You make normal monthly payments just like any other loan. I reviewed the two largest peer lending sites, Lending Club and Prosper, in a previous article that highlights fees, interest rates and other important information.

There is really nothing new about peer lending and crowdfunding loans. Investors have been putting money on loans for ages, they just had to do it through a middleman bank or brokerage firm. Now, investors can directly contribute to someone’s loan. Investors get a high rate of return and borrowers get the money they need at a reasonable rate.

Advantages of Peer Lending versus Crowdfunding

One of the biggest advantages to peer loans, especially compared to crowdfunding, is that you are almost guaranteed to get the money requested. Sure there’s a verification process for the information in your application and you need a minimum credit score, but there is so much demand from investors that loans are being fully funded in a matter of hours on the major websites.

As easy as it is to launch a crowdfunding campaign, it’s even easier to apply for a peer loan and it’s completely free. The peer lending platforms first do a “soft check” on your credit so it is not used against your credit score. If you approve of the loan rate and terms, another “hard check” is done to verify your credit and shows up as an inquiry on your credit report.

Compare that speed of funding and guarantee against running a crowdfunding campaign. It can take months to pre-launch and manage a good campaign and you won’t get a dime if you don’t meet your funding goal. You don’t have to repay the money but you will have to pay taxes on it and deliver rewards. In the end, many crowdfunders make little or no profit off their campaign though it can still be a great resource for businesses.

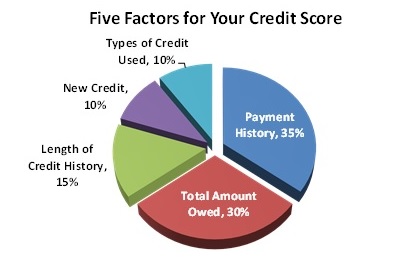

An unknown benefit of peer loans is that they can help build your credit score. Peer loans are reported on your credit report as non-revolving credit, loans that have a fixed time limit rather than revolving loans like credit cards.

Non-revolving credit doesn’t hurt your credit score as bad as the revolving type because payments and the payoff are fixed. The types of credit on your credit report accounts for up to 10% of your credit score so reducing the amount of revolving credit through debt consolidation can help increase your score.

Want to better understand your credit score and bad credit factors? Check out this post on credit score factors and how to increase your score.

Debt consolidation is the biggest use for peer loans, borrowing at a lower rate to pay off high-interest credit cards. Not only do you reduce the number of credit accounts with balances on your credit report but you change the type of debt on your report.

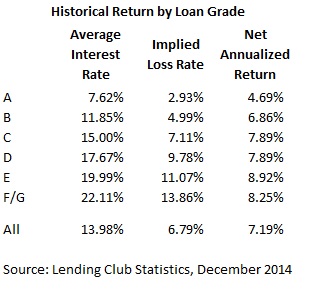

The upside for investors in peer loans is that they can get high rates of return for a relatively safe fixed-income investment. Average returns are around 7% but can be safely increased with a loan picking strategy like one peer lending investor shared with us.

P2P loans aren’t just for personal debt. I know business owners that have used peer loans for quick capital needed to pay for supplies. The advantage of most peer loans over traditional short-term business loans is that you’ll get years to pay off the loan and don’t need to show financial statements for loan approval.

Disadvantages of Peer Lending

The most obvious disadvantage to a peer loan versus crowdfunding is that it has to be repaid and interest rates can be can get fairly high for poor credit borrowers. The table below shows the average interest rate and investor returns for loans across the seven risk categories on Lending Club.

Rates can start as low as 6.5% but can zoom higher depending on your credit score. The major peer lending sites Prosper and Lending Club will originate loans to borrowers with credit scores as low as 640 on the FICO scale.

Lending Club may be better as a small business lender with loans up to $350,000 for businesses open two years and $50,000 or more in sales. Fixed rates are competitive on terms up to five years and you don’t need collateral for loans up to $100,000.

The most common complaint I hear about peer lending is the credit score needed for a loan on Lending Club. The credit score requirement shuts a lot of people out of a great tool for consolidating their debt. For borrowers that don’t qualify for a Lending Club loan, I like Personal Loans.com as an alternative. You fill out your loan request and then lenders bid on your loan for the best deal available. Credit scores as low as 580 are generally accepted and the site may be able to source a traditional bank loan at lower rates.

Click to Apply for Personal Loans up to 35,000

Fortunately, there are ways to get a lower rate in peer lending. Three-year loans are typically offered at lower rates and working on your credit score for a couple of months can help decrease your loan rate.

Loan sizes are limited in peer lending, up to $35,000 for personal loans though you can get up to $300,000 for a business loan on Lending Club. The limit on personal loans is still way above what you would likely raise crowdfunding so may not be as much of a drawback. Most crowdfunding campaigns (72%) raise less than $10,000 and many fail to even reach their funding goal.

Another disadvantage of peer lending is that it is still restricted in some states. Loans are not available in Maine, Iowa and North Dakota for Prosper borrowers with Idaho and Nebraska locking out borrowers on Lending Club as well.

The biggest disadvantage of peer lending is that your peer loan will not offer the marketing or outreach for your cause or business that you’d get with a crowdfunding campaign. With a crowdfunding campaign, you get a whole page on the internet to display all the best qualities of your cause or business, including a video appeal. It’s all free and you get to put it on a website that has huge search ranking power and tons of traffic.

Are there Crowdfunding Loans Options?

Besides peer to peer lending, there are a few options in crowdfunding loans and personal debt. I highlighted some of the top crowdfunding sites for personal debt in this list of peer to peer lending sites. It includes sites like Zidisha, GreenNote and Lendkey which are kind of hybrid websites between crowdfunding and peer lending.

The way these websites work is that you fill out a loan profile without how much you need and an interest rate you are willing to pay lenders. You then have to reach out to friends, family and your social network to ask them to fund the loan. It’s like social lending within your circle of friends.

The way these websites work is that you fill out a loan profile without how much you need and an interest rate you are willing to pay lenders. You then have to reach out to friends, family and your social network to ask them to fund the loan. It’s like social lending within your circle of friends.

Interest rates can be lower for these loans because you set them yourself. There are a couple of problems with these crowdfunding loan options though. First, the crowdfunding sites don’t have organic traffic. Basically, there’s no crowd coming to the site and you’ll have to fund your loan exclusively from the people you know. It can be a little awkward asking for the money from your social network and it still runs the risk of destroying relationships if you miss a payment.

For these reasons, I still like traditional peer to peer lending rather than crowdfunding personal debt. P2P sites already have their own network of investors and don’t need you to open up your social network for lenders.

Crowdfunding Student Loans

There are a few crowdfunding sites that are specializing in crowdfunding student loans but most of the stories I’ve heard have been from people using the larger sites like GoFundMe or Kickstarter to crowdfund their education.

Social crowdfunding sites like GoFundMe are going to be more difficult to crowdfund your student debt unless you have a very big and supportive social network. Most of the funding will come from your friends and family.

If you’ve built up a strong social network online, you might be able to fund some of your debt. The upside to social crowdfunding sites is that you usually get to keep any amount contributed by supporters rather than meet a funding goal.

Using rewards-based crowdfunding sites like Kickstarter may be easier to fund your student loans or education costs. You’ll have to develop an idea around rewards and why people should fund your education but this isn’t difficult and you might be able to use it as some kind of course project.

SoFi started as a student loan refinancing site but has since expanded into mortgages, personal loans and medical loans. The rates on student loan financing are some of the lowest available so it’s a great option if you can’t get your debt crowdfunded.

Upstart is a personal loan site that specializes in student loans and graduate borrowers. Instead of simply looking at your credit score for your loan application, the site uses a unique scoring model that includes your academic achievement and where you went to school.

Check your rate on Upstart now – won’t affect your credit

Crowdfunding Micro Loans

Most crowdfunding is micro loans so there is something of a misunderstanding here. For banks, any loan for less than $50,000 is considered a micro loan. Since the average crowdfunding amount is less than $35,000 – micro loans are the crowd.

But when many people talk about micro loans, they’re thinking about a very specific type of loan. Usually we’re talking about small loans of less than $5,000 to people for special projects or business ideas and usually in emerging countries.

Since the financial system is often underdeveloped in these countries, crowdfunding these projects is the perfect solution. Sites like Kiva and Zidisha are a good example of these types of crowdfunding.

Crowdfunded loans on these sites are usually paid back but with no interest and supporters do not typically get any type of reward other than being able to help someone with their project.

Crowdfunding loans for Small Business

Crowdfunding loans for small business has become more popular since the financial crisis. Traditional banks were burned by their small business loans and have almost completely stopped lending to entrepreneurs over the last decade.

Sites like Lending Club and StreetShares have become significant lenders to the small business community. Lending Club started as a personal loans site but has since become one of the largest providers of peer-to-peer lending for business owners.

It’s more difficult to get a crowdfunding loan for small business compared to a personal loan. Most sites require at least two years in business and a certain amount in annual sales. If you are not able to get a small business loan, a personal loan is the next best option and rates are about the same.

Check your rate on a business loan from Lending Club

Is Crowdfunding or Peer to Peer Lending Better for You?

So which form of financing is best for your project? The truth is probably somewhere in the middle. I have talked to crowdfunding campaigns that used a peer loan to pay for upfront costs like marketing and outreach for their crowdfunding campaign. Just as traditional businesses might finance its operations with loans and shared ownership, you might also choose to finance your dream project with both peer loans and crowdfunding.

If you’re still not sure about the advantages of peer lending over crowdfunding, click through to this free peer lending video and guide about p2p. The revolution in peer-to-peer and crowdfunding loans is only just getting started. Learn how to take advantage of the trend to consolidate your debt and raise money for your small business dreams.