Fund Accounting Basics: What Nonprofits Need to Know

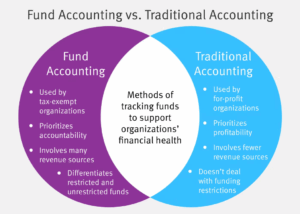

A strong accounting system is key to building an adaptable, sustainable organization. But unlike your for-profit counterparts, your nonprofit must use fund accounting practices rather than traditional accounting methods.

Jitasa’s guide to fund accounting defines this term as “a method of financial management that tracks the amount of money allocated to various operations at a tax-exempt organization.” Fund accounting is a crucial part of your nonprofit’s ability to demonstrate transparency to stakeholders and ensure your long-term financial health.

In this guide, we’ll walk you through the need-to-knows of fund accounting: how it differs from traditional accounting, its core elements, and its applications.

Why Fund Accounting Is Unique

Fund accounting has the same basic function as traditional accounting: both are methods of tracking funds to support their organization’s financial health. But while the goal of business accounting is to maximize profits, nonprofits use fund accounting to demonstrate accountability. Fund accounting also tracks many different sources of revenue, such as individual donations, corporate philanthropy, earned income, investments, and grants.

Benefits of fund accounting for your nonprofit include:

- Compliance: Fund accounting is essential to meet nonprofit reporting requirements, which help ensure you maintain your tax-exempt status.

- Effective resource allocation: When you know how much funding is designated for certain initiatives, you can better prepare to fund all of your projects, programs, and overhead costs.

- Building trust with stakeholders: Fund accounting demonstrates your commitment to using supporters’ funds wisely and honors their contributions to your organization.

Remember that your organization can only access these benefits if your fund accounting is apparent in your publicly available documents and statements. Give your stakeholders the peace of mind that you’re using their funds thoughtfully and honestly by prioritizing transparency in your communications.

Types of Funds in Fund Accounting

In fund accounting, funds are recorded according to whether contributions have been designated for specific purposes—i.e., whether they’re restricted or unrestricted.

Restricted funds are contributions that stakeholders have earmarked for a specific program or initiative. Restricted funds can be permanently or temporarily restricted. Permanently restricted funds typically fund an ongoing, donor-designated initiative in perpetuity. Temporarily restricted funds, on the other hand, are limited to a specific timeframe or purpose but can later become unrestricted if the donor or funder agrees to it.

Examples of restricted funds include:

- Endowments funding an ongoing scholarship. These funds are typically permanently restricted.

- A foundation grant awarded for a specific program.

- Major gifts to a capital campaign explicitly designated for a particular project. These funds are typically temporarily restricted.

Unrestricted funds, on the other hand, are donations that you can apply wherever they would do the most good. These funds are vital because they allow for flexibility in day-to-day operations, staffing, or program development. Examples include:

- General donations collected during an annual giving campaign.

- Corporate volunteer grants or matching gifts that do not specify use.

- Proceeds from a fundraising gala where no donor-imposed restrictions apply.

The complexity of fund accounting makes it critical to configure your accounting software properly from the start. By setting up fund categories during implementation, you can automate the tracking of restricted and unrestricted contributions to ensure compliance, simplify audits, and save staff time.

Fund Accounting Applications

Fund accounting touches nearly every aspect of your nonprofit’s financial management. Many essential financial documents are inextricably linked to fund accounting systems—which is why it’s vital that you set up your accounting software properly. Fund accounting has a major impact on these documents and practices:

- Chart of accounts: This directory of your nonprofit’s financial records should reflect your use of fund accounting. For example, you should segment the net assets section, which reflects your organization’s total worth, into categories of unrestricted, permanently restricted, and temporarily restricted funds. Similarly, your revenue section should include designations for various types of restricted funds (grants, sponsorships, endowments, etc.).

- Budget: Fund accounting should be at the forefront of your mind when creating your operating budget. Allocate restricted funding to the correct initiatives before considering how you actually have available to pay for other programs and overhead costs.

- Financial statements: Your statement of activities (which outlines your nonprofit’s revenue, expenses, and net assets) and statement of financial position (detailing your assets, liabilities, and net assets) should both differentiate between restricted and unrestricted net assets to give an accurate picture of your financial situation.

- Annual report: DonorSearch’s nonprofit annual report guide emphasizes that “being honest and transparent about your spending and fundraising builds trust with your existing supporters.” A major way to demonstrate transparency is to use your fund accounting data to create visualizations of how your organization has chosen to allocate funds so that annual report readers can easily interpret important financial information.

Because fund accounting impacts so many essential documents, mistakes can carry long-term consequences. If your team struggles to align funding designations across budgets, statements, and reports, consulting a nonprofit accountant can prevent compliance issues and restore clarity.

Proper fund accounting demonstrates that your nonprofit honors donors’ wishes regarding their contributions, is willing to communicate transparently about finances, and will make wise decisions regarding its finances. When you understand the distinctions between different types of funds and apply them across your financial documents, you can strengthen trust with donors and support long-term stability.