Incorporating Matching Gifts Into Your Donation Forms

As your organization continues to seek new ways to collect revenue, grow donor relations, and establish long-term partnerships, there might be a prime opportunity you’re not tapping into: matching gifts.

Here at Crowd101, we’ve written about corporate matching gifts before—and for good reason. When organizations integrate matching gifts in their fundraising strategies (from dedicated match drives to integrated event promotions), the results tend to be astounding.

And one of the best ways to promote matching gifts is directly within your donation forms!

But is your team doing everything it can to position your organization for success from its online giving pages? Read along to find out—and see what other tips and tricks you pick up to enhance your strategy along the way.

The Matching Gift Opportunity | An Overview

Before we jump into the specifics of matching gifts and donation forms, let’s review the basics. It’s important to have a solid grasp on matching gifts beforehand in order to guide your efforts later on.

Top tip: Interested in scaling up your knowledge with a full crash course of all things matching gifts? Check out Double the Donation’s online Matching Gift Academy to learn more!

Otherwise, here’s what you need to know:

What Are Matching Gifts?

Matching gift programs (also known as company, workplace, or employee matching gifts) are a popular form of corporate philanthropy in which businesses match donations their employees make to eligible nonprofits. This allows companies to improve their social responsibility efforts while engaging with employees in a new realm.

From the donor’s perspective, it allows each dollar to go twice as far—empowering individuals to make a significantly greater impact than they could have produced on their own. And for the nonprofit side, the organization receives additional corporate funding and higher rates of individual giving, too.

We like to think of it as receiving free donations through a “Two for One” sale on charitable funding!

How the Matching Gift Process Works

Though the logistics can vary from business to business, the overall matching gift process follows a few vital steps. And it typically looks like this:

- A donor gives to a nonprofit.

- The donor requests a matching gift from their employer.

- The employer confirms that the gift adheres to program guidelines.

- The employer verifies the initial donation with the nonprofit.

- The employer contributes a matching donation.

It’s a pretty straightforward scenario, and most companies’ submission processes are quick and simple, too. However, nonprofits often miss out on available match funding because donors don’t take the steps to request associated matches from their employers. And that is most often due to a lack of awareness regarding the programs’ existence—let alone knowledge of specific criteria or submission requirements.

And that brings us to our next topic!

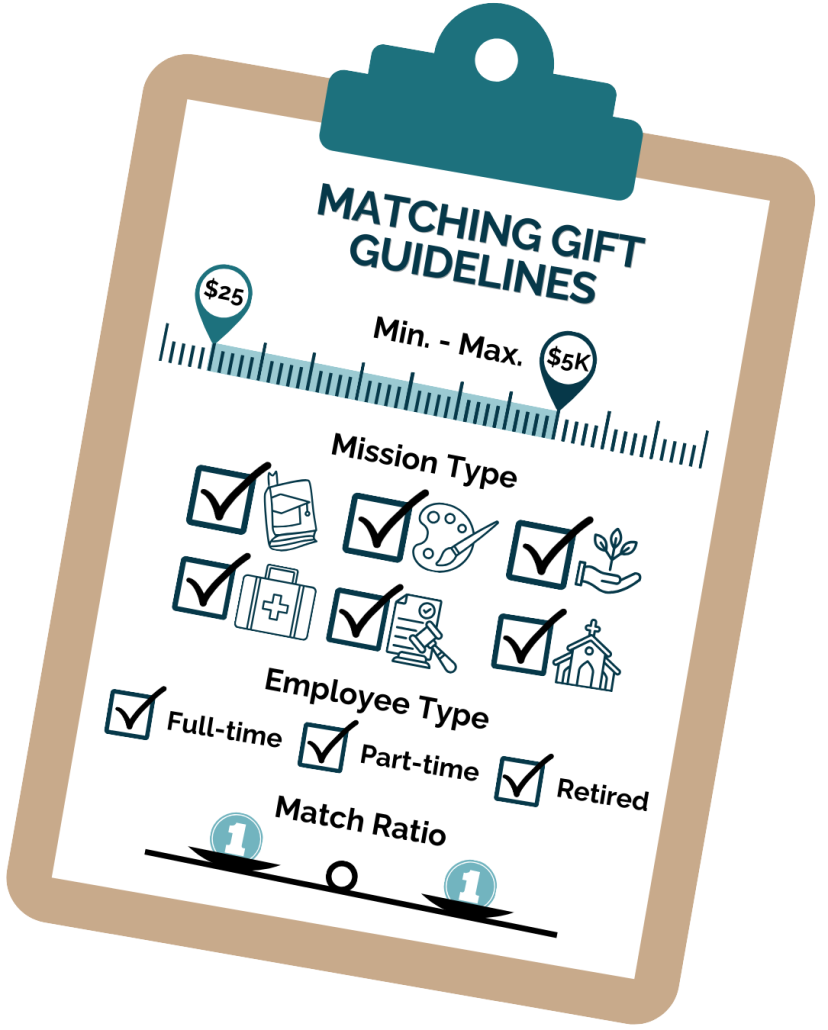

Guidelines for Matching Gift Programs

Speaking of submission requirements, most companies establish rules and guidelines that define match-eligible donations and the subsequent request process. You and your donors will need to know how to locate this information—and even what to look for—in order to guide your supporter outreach strategy.

In a nutshell, a company’s giving policy or other program documentation should allow your organization to answer the following questions regarding a potential match:

- Is my organization eligible? To receive a matching donation from a company, your organization must meet certain requirements (such as tax filing status and mission type). The most common exclusions pertain to strictly religious and political organizations, but you’ll want to be sure your organization falls under the company’s purview regardless.

- Is my donor eligible? Even if a donor works for a matching gift company, their employment type might affect their eligibility. Make sure your donors know which team members qualify (full-time, part-time, retired, spouses, and more) in order to obtain the most accurate information. Not all companies will match retiree gifts, for example, while others may adjust their limits or ratios based on the individual’s employment level (e.g., a double match for full-time staff versus a standard match for part-timers).

- Is the amount eligible? Companies also typically specify the minimum and maximum donation amounts they’ll match. Most minimums tend to fall around $25, while maximum limits can range from $1,000 to $100,000 or more.

- What’s the match ratio? In addition to minimum and maximum amounts, companies also establish a match ratio that dictates whether the donation will be matched dollar for dollar—or at another rate entirely. Though most companies match at a 1:1 ratio, ratios can range from .5:1 to 4:1.

These criteria might seem like a lot for donors to keep track of on their own—let alone your organization managing program guidelines for all its supporters. That’s one of the reasons why available matching gift funding often goes unclaimed.

But it doesn’t have to be complicated when you equip your team with the right resources, and we’ll share how to do so effectively with your donation forms below.

Understanding the Matching Gift Gap

Matching gifts hold immense potential for organizations looking to maximize their impact. However, there’s a significant gap in donor awareness regarding the opportunity, which ultimately leads to a large portion of available matches going unclaimed.

But your online donation page can be your saving grace!

Don’t believe us? Check out these statistics:

According to a recent study by Double the Donation, nearly 78% of donors are unaware that their employers offer matching gifts. Meanwhile, only 1.31% of individual contributions are matched, on average—despite more than 10% qualifying for the programs.

The result? Though an estimated $2.9 billion is contributed through matching gift programs each year, an additional $4 to $7 billion is being left on the table each year.

To proactively address the matching gift gap and unlock untapped funds for your cause, incorporating information about matching gifts in your donation forms is a must. This empowers donors at the height of their engagement to take full advantage of their matching gift potential.

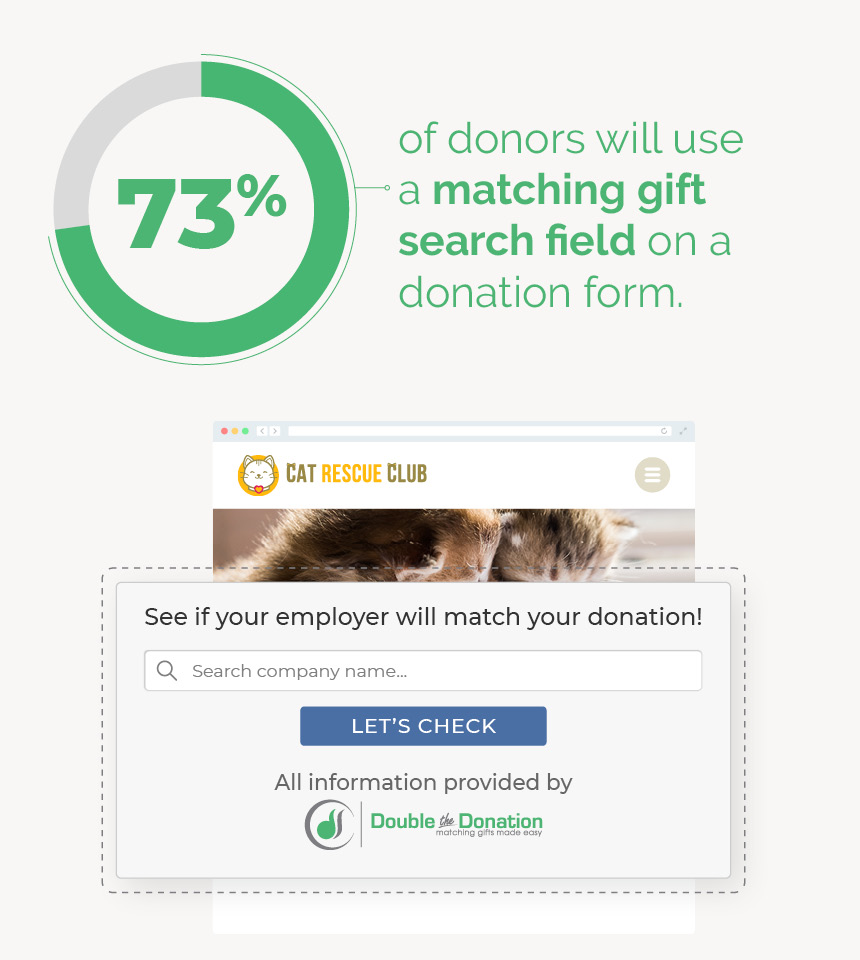

And the good news is that supporters are typically eager to do so! In fact, fundraising research reports that over 73% of donors will utilize a matching gift search field on a donation form when they are presented with the opportunity.

When provided with accurate, up-to-date employment information, your team will be better prepared to pursue matching gift opportunities accordingly!

How to Add Matching Gifts to Your Donation Forms

The #1 most effective way to raise matching gift awareness throughout your donor base? Feature matching gifts right on your donation form.

Your donation form represents the point at which donors are at the top of their engagement with your organization. They’re serious about giving to the cause, and they’ll be most receptive to the information you provide. Make the most of that momentum by highlighting matching gift opportunities right where they are: your giving page!

The following practices set you up to integrate matching gifts into your donation process successfully:

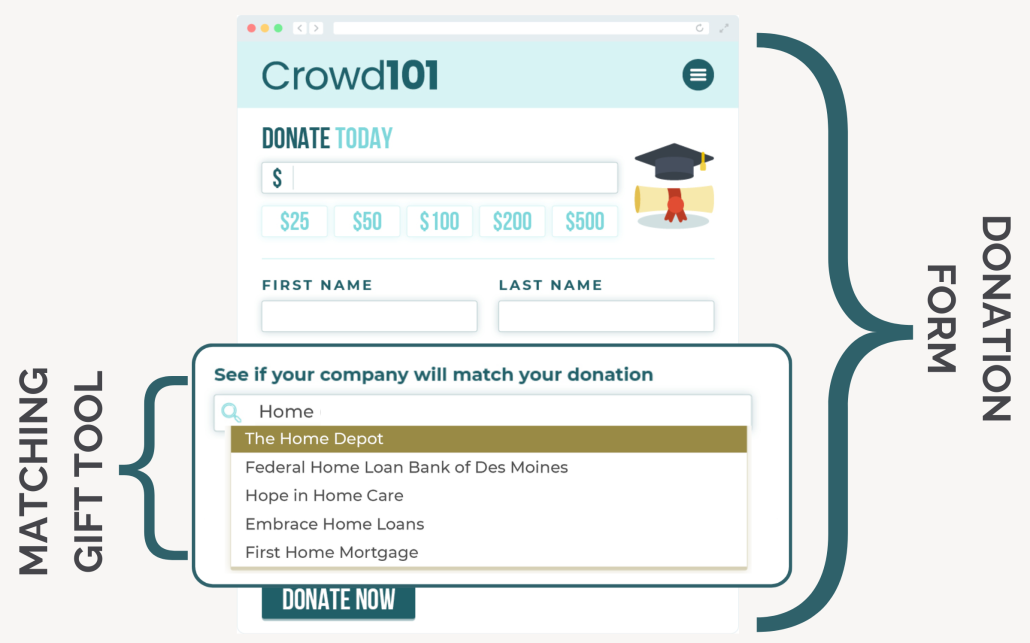

1. Choose an appropriate donation form software provider.

The ease with which your team incorporates matching gifts into your donation forms can depend on the donation form software you use. For example, many providers offer ready-built integrations with a matching gift tool like Double the Donation.

Such integrations allow you to add matching gift functionality to your forms in seconds—with little to no coding experience required.

Choosing a platform with powerful matching gift potential—and configuring your tools’ integrations accordingly—enhances organizational efficiency and minimizes missed match opportunities. And it uses information provided during the donation experience to do so!

Ultimately, if you’re in the market for a new donation software, we recommend prioritizing one with a matching gift partnership in tow.

(P.S., Double the Donation has a handy donation software search tool on their website to make your selection as easy as possible!)

2. Mention matching gift opportunities on your giving page.

Donors who navigate to a giving page typically expect to find a summary of the organization’s background, mission, and specific campaign efforts. Thus, when you set up your donation forms, you’re generally invited to customize the text, images, style, and more to really make it your own.

But it’s also a good opportunity to plug in matching gifts!

Consider adding a few brief but compelling sentences about matching gift programs on your donation form. Thus, the prominently positioned blurb can educate donors about matching gifts and encourage them to learn more. Meanwhile, using concise language, compelling statistics, and visually appealing designs can capture donor attention and convey the matching gift message effectively.

The caveat to this option, however, is that your supporters still need to do a lot of the leg work themselves. Even if your organization informs a donor about matching gifts, they’ll still need to research the company’s guidelines on their own. Not to mention, linking to additional matching gift resources from your donation form risks donors clicking away and not returning.

Luckily, solutions like Double the Donation are designed to mitigate these roadblocks, empowering organizations to make the most of matching gifts within their donation forms. Keep reading to learn how!

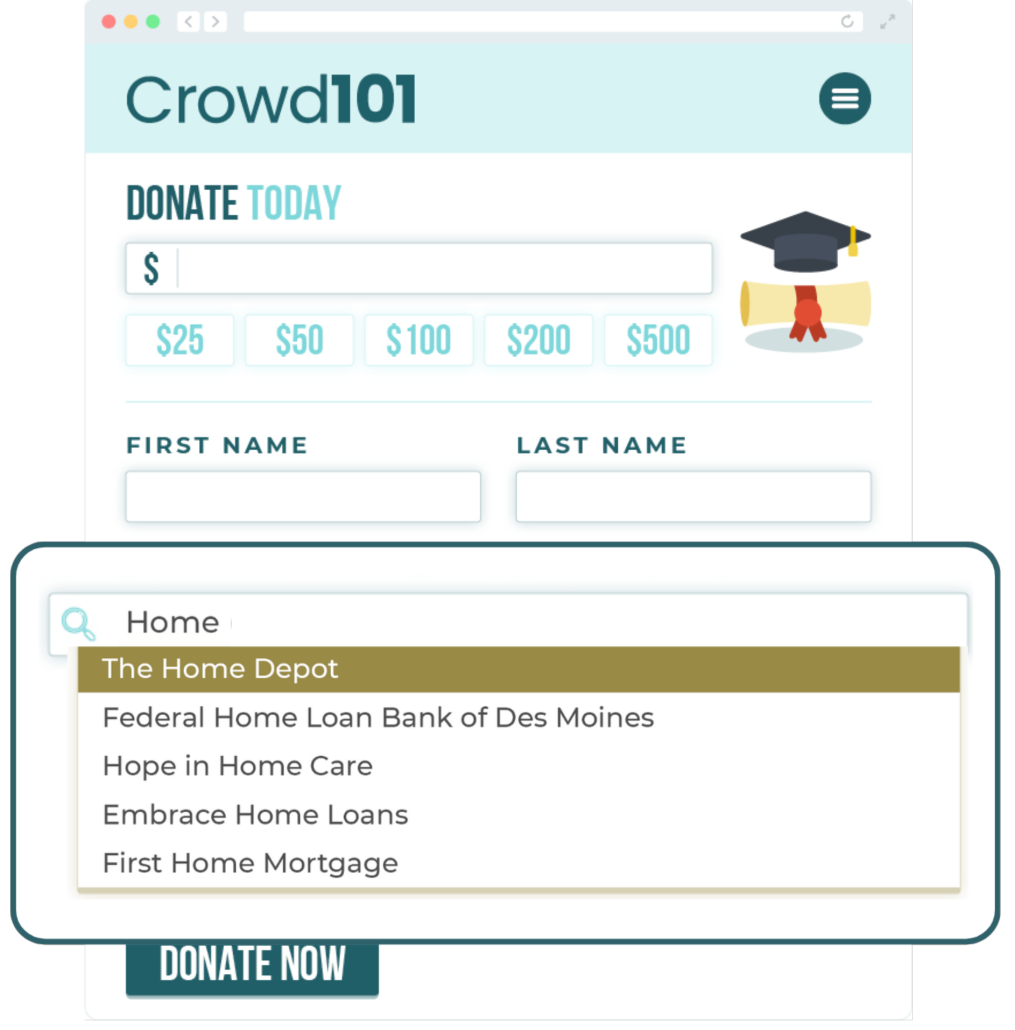

3. Implement a donation form field to collect employment data.

A donor already provides a wealth of information on an organization’s giving page as they complete their gift. This might include the individual’s name, contact information, communication preferences, payment details, and even their reason for giving.

In order to power your matching gift efforts, take your strategy a step further and request employment information at this time, too!

An embedded company search tool is ideal for doing so. When integrated into your donation forms, a matching gift database widget auto-completes company names and accounts for subsidiaries and spelling variations. It ultimately ensures your employment data is provided in a standardized and easily digestible format!

However, even instituting an additional plain-text form field allows your team to collect additional insights, guide your strategy, and deepen your understanding of donor employment backgrounds.

Interested in learning more about matching gift software (and our suggested provider)? Jump to that section now.

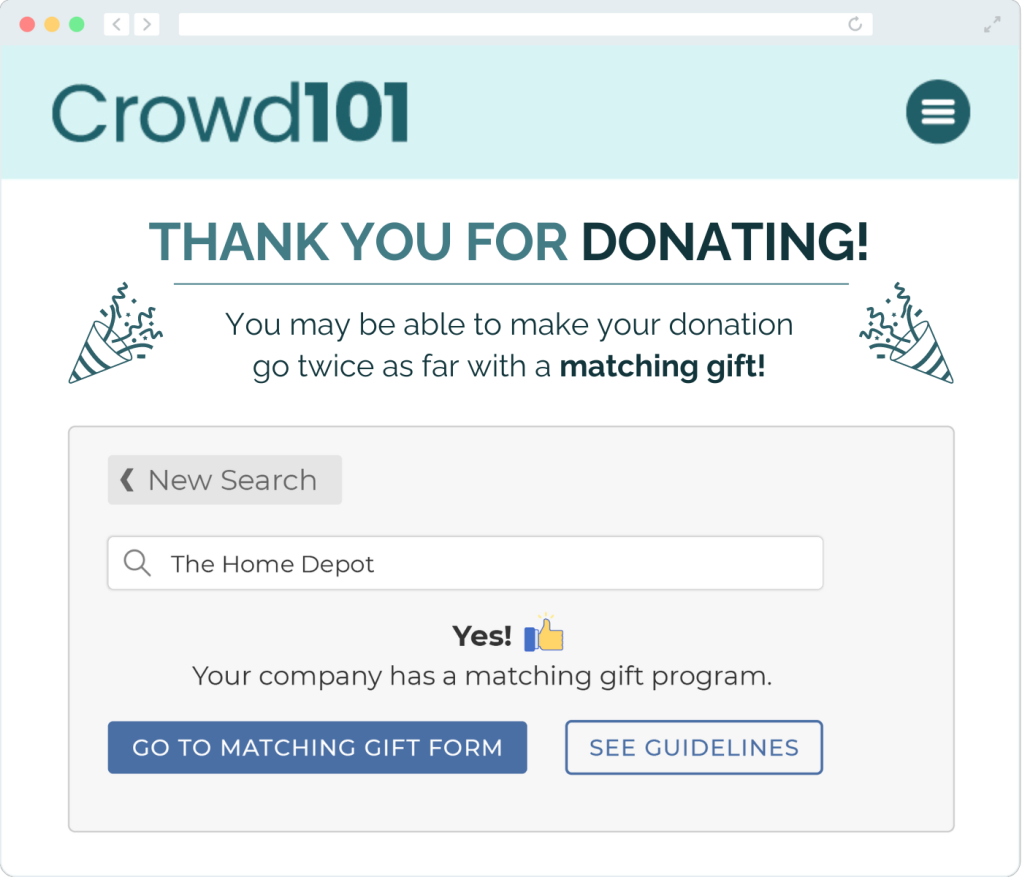

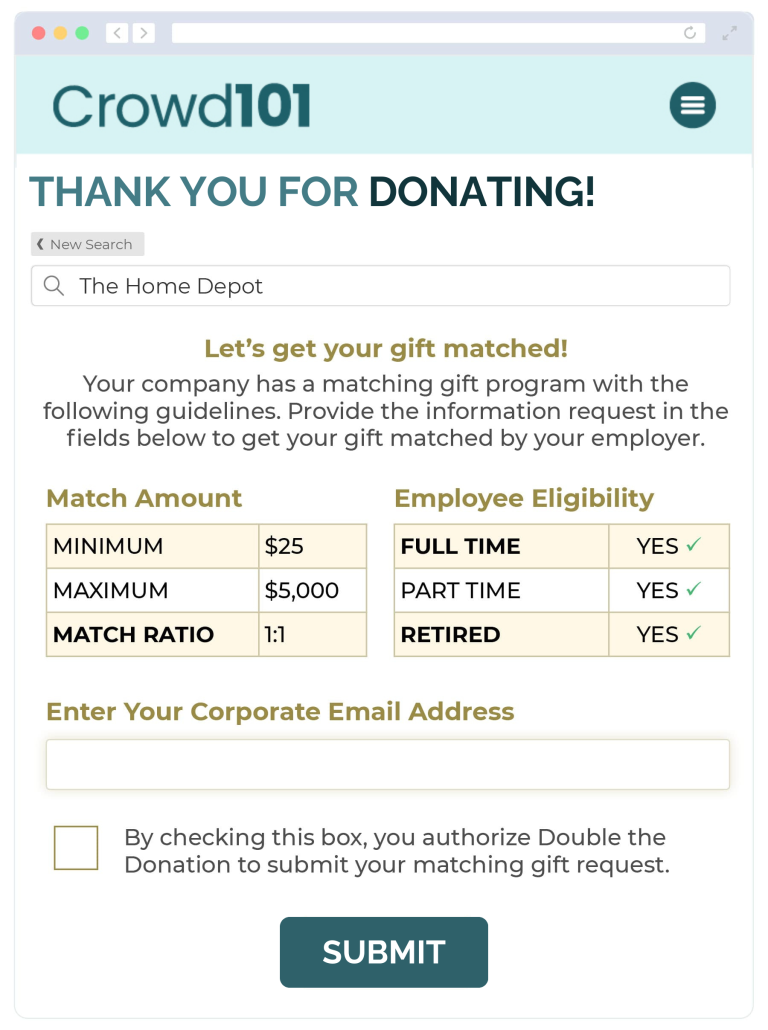

4. Provide actionable next steps from the confirmation screen.

When a donor clicks “submit” on your donation form, they’re likely redirected to a confirmation page or thank-you screen acknowledging their gift. At this point, a strategic touch point on your confirmation page can be just what you need to encourage donors to complete their matches right away.

And if the individual provided employment details within the giving form, you’ll want to ensure they’re provided with clear and actionable instructions on how to complete the match process for their employer.

Your confirmation screen should also provide donors who did not interact with the search tool on your donation page a chance to look up their employer on the spot. Within seconds, they, too, can access company-specific program criteria, links to match submission forms, and any other relevant information.

All in all, facilitating the process immediately after a donation captures the donor’s momentum at its height. And it makes it exceptionally easy for them to maximize their impact with employer matching gifts.

Driving Matching Gift Submissions Post-Donation Page

Now, let’s say a donor has exited your giving form after completing the transaction process. Although they have yet to submit a match request to their employer, all hope is not lost!

Here are a few things you can do to re-engage matching gift donors after the donation form stage in their journey.

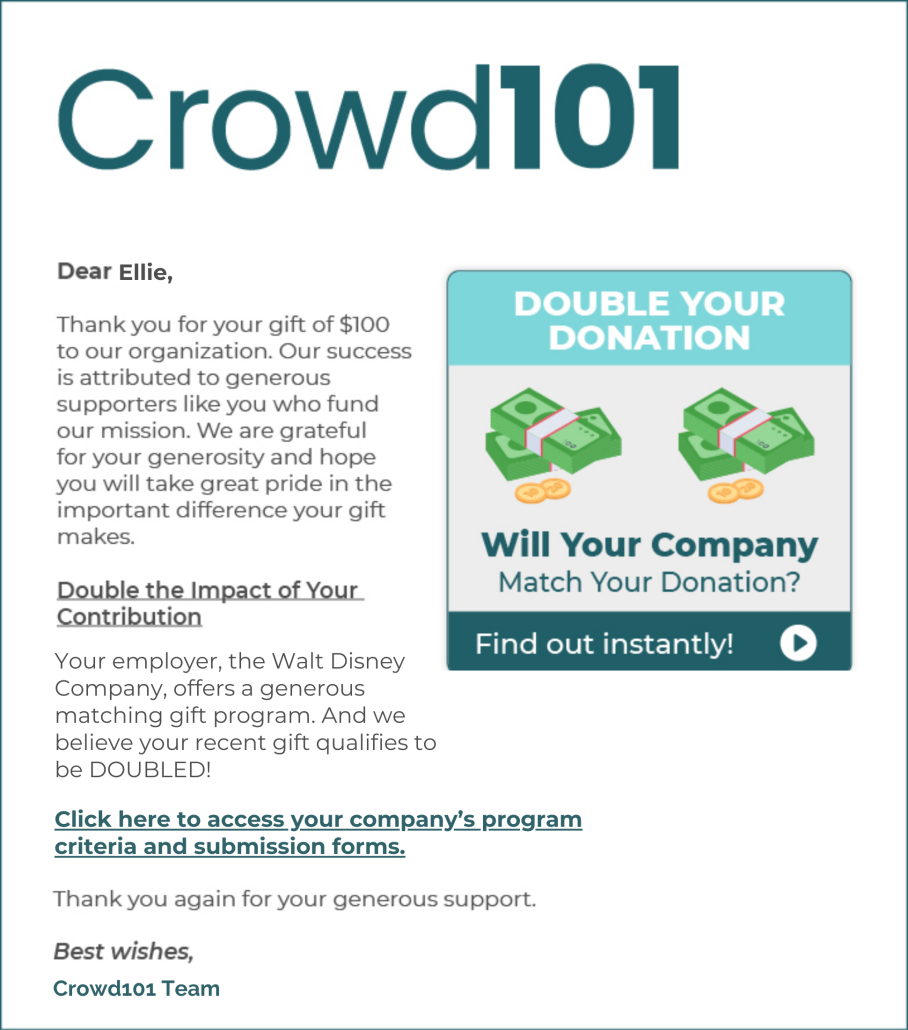

Matching Gift Follow-Up Emails

Another great way to grab your donors’ attention after they give is by sending personalized follow-up emails within hours or days of their initial donations.

You don’t want to lump this message in with your confirmation or acknowledgment emails, though. Those communications are generally skimmed and forgotten.

Your matching gift reminder email, on the other hand, should be designed to shed light on the often-overlooked opportunity. And remember to complete it with a specific call to action that drives more matches to the finish line!

Here’s a sample email an organization might send to encourage matching gift participation among donors:

As the image describes:

Thank you for your gift of $100 to our organization. Our success is attributed to generous supporters like you who fund our mission. We are grateful for your generosity and hope you will take great pride in the important difference your gift makes.

Double the Impact of Your Contribution

Your employer, the Walt Disney Company, offers a generous matching gift program. And we believe your recent gif qualifies to be DOUBLED!

Click here to access your company’s program criteria and submission forms.

This message thanks the donor for their gift and alerts them to the fact that their company might be able to make their donation go further. And it uses data collected within the recipient’s donation form to enable a personalized and guided experience!

Keep in mind that in this scenario, timing matters. Matching gift experts generally recommend triggering follow-up emails to go out in the first 24 hours after a donor gives. Emails sent in this time frame see a 53% open rate, which is over 2.6 times the industry average.

Gift Eligibility & Submission Forms

Matching gift software does more than tell your donors whether they’re eligible for matching gifts. The right solution takes the user directly to where they need to go to make the actual request.

Why? When you send donors straight to their employers’ matching gift forms, you can significantly boost the number of complete submissions.

However, it’s a good idea to note that each company’s request procedures can vary—ranging from print-and-mail forms to fully online submission portals. Thus, the ways you guide your donors through the process can look different, too.

Paper Matching Gift Forms

Nowadays, paper matching gift forms are not as common as they once were. Still, some companies continue to accept matching gift submissions this way, so it’s important to understand how they work.

Typically, paper matching gift forms require these primary components:

- Employer identification numbers

- Personal information

- Donation amount

- Recipient organization’s name

- Nonprofit mission type (cultural, educational, etc.)

- Donation date

Once the form has been located and completed, it should be sent according to the company’s preference (e.g., mailed, faxed, etc.).

From there, corporate management uses the provided information to review the request and ensure that the necessary guidelines have been met. Finally, the company may verify the initial gift with your organization before completing the match.

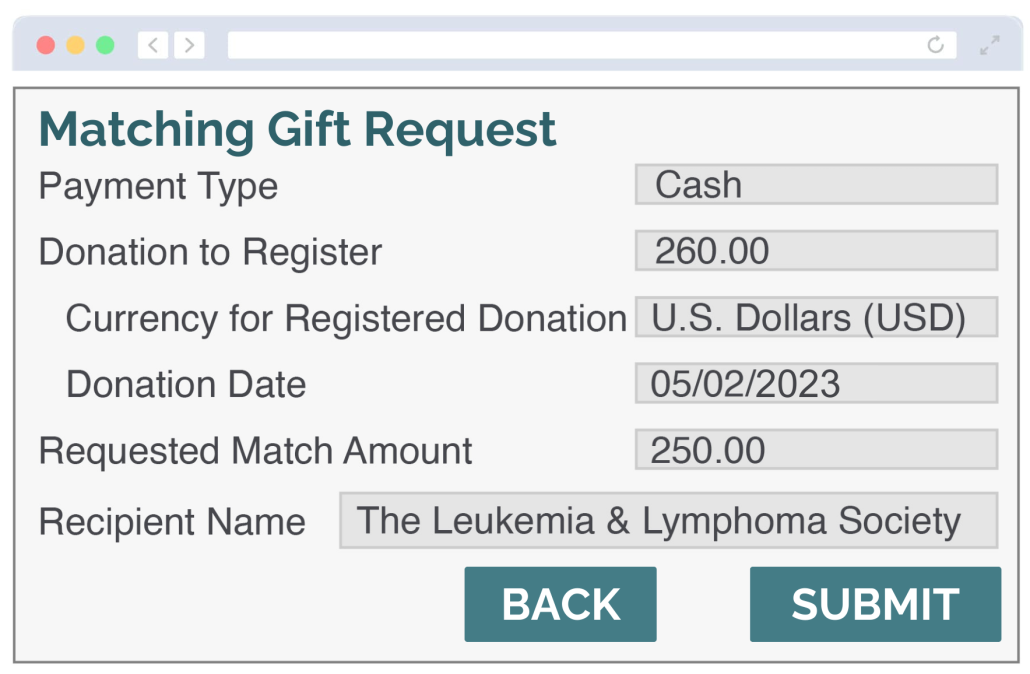

Electronic Matching Gift Forms

Most companies have made (or are currently making) the shift to electronic matching gift forms as a way to streamline the process for all parties involved. When submitting a match is as easy as filling out a brief online form, more donors are likely to take part.

The process generally looks like this:

- A donor accesses an electronic matching gift form online (on the company’s website or using a third-party resource).

- The individual locates the name of an organization from a list of pre-approved 501(c)(3) nonprofits (or requests to have the organization added to the platform).

- The individual provides details about their recent donation, such as the gift amount and transaction date.

- The individual clicks submit, and their employer automatically receives the request for approval!

At this point, the company reviews the submission, your team may verify the original donation, and the company triggers its completed match!

Electronic submissions also pair well with online donation forms and matching gift software. When a donor completes a search for their company using your database tool, they’ll receive a link that sends them right to the login page for the correct form. It makes the match request almost like an extension of the original donation experience!

Matching Gift Auto-Submission

For a while, we thought things couldn’t get any easier than electronic matching gift forms. But then auto-submission proved us wrong!

Now, there’s a way for supporters to complete the matching gift request process directly from an organization’s donation forms.

Here’s how it works:

- When a company facilitates its matching gift program through a CSR platform with auto-submission functionality, it can enable this type of submission option for its employees.

- Then, when an employee completes a donation to an organization that subscribes to Double the Donation’s matching gift automation tool, they’re flagged as a candidate for auto-submission.

- If that’s the case, when the individual completes their donation, they’ll be prompted to submit a match request right from the gift confirmation screen. Typically, all they need to do is provide a corporate email address to complete a matching gift within the initial donation process itself.

Then, Double the Donation’s system automatically compiles details the company needs to process the request—and sends the information behind the scenes!

Matching Gift Tracking and Reporting

Incorporating matching gifts in your donation forms is a strategic move that can elevate the impact of your organization and its fundraising efforts. However, true success relies on your ability to track, report on, and improve your matching gift performance.

The more you learn about donor behavior regarding matching gifts and your donation forms, the better you can craft a strategy that largely appeals to your audience.

For example, understanding how donors interact with a matching gift component on your donation forms is key to optimizing their impact and potential. Does the placement of the matching gift search tool within your donation form affect its rate of engagement? Do you see a higher conversion rate on your giving pages that highlight matching gifts?

Asking questions of this nature can illuminate aspects of your strategy with room for improvement while also enabling your team to acknowledge and celebrate its successes.

Selecting a Matching Gift Database Solution

Leveraging matching gift software is obviously an excellent way to incorporate matching gifts into your donation forms and provide donors with the information they need.

But how do you decide which solution to use?

Good news: we’ve done the brunt of the work for you. Check out our detailed breakdown of the main matching gift tools here—or read up on our top recommendation below.

Our Favorite Matching Gift Database: Double the Donation

If you’re seeking a robust matching gift database with which to incorporate matching gifts in your donation forms, Double the Donation is the solution you need.

As Double the Donation’s flagship product, 360MatchPro is an innovative automation platform that essentially streamlines every aspect of the matching gift process on your behalf. It even comes with a user-friendly search tool that’s easy to embed in your giving pages.

When a supporter fills out an online donation form with 360MatchPro enabled, the platform scans their data (including provided employer information, corporate email domains, and more) to determine their eligibility for a match.

From there, Double the Donation automatically provides the donor with detailed instructions regarding their employer’s submission process. That includes providing direct links to the company’s match request forms from the confirmation screen or follow-up email!

And the best part? It seamlessly integrates with 90+ of the largest fundraising platforms.

That means it’s easier than ever for organizations like yours to add a matching gift element to their donation forms.

Additional Matching Gift Resources

When it comes to online fundraising, your donation forms are some of your organization’s most invaluable resources. It makes sense to include matching gift information alongside these assets in order to scale up your giving and engagement.

Remember: your donors want to be involved in their employers’ matching gift programs when they understand the opportunity being presented. But it may require a proactive approach to inform and guide supporters along the way.

For donors, the matching gift experience has to start somewhere. Doing so directly within the donation process is your best bet!

Want to learn more about matching gifts? Here are a few additional corporate giving educational resources from Crowd101:

- Essential Questions About Corporate Matching Gifts. Get a rundown of all things matching gifts by asking these essential questions.

- Review of HEPdata, Amply, and Double the Donation. Not sure which matching gift software is right for you? Read our detailed reviews here.

- Top 18 Matching Gift Programs Your Nonprofit Should Know. There are a lot of matching gift programs in the world. Check out the top programs that made our list!