Corporate Matching Gifts FAQ | Your Questions, Answered

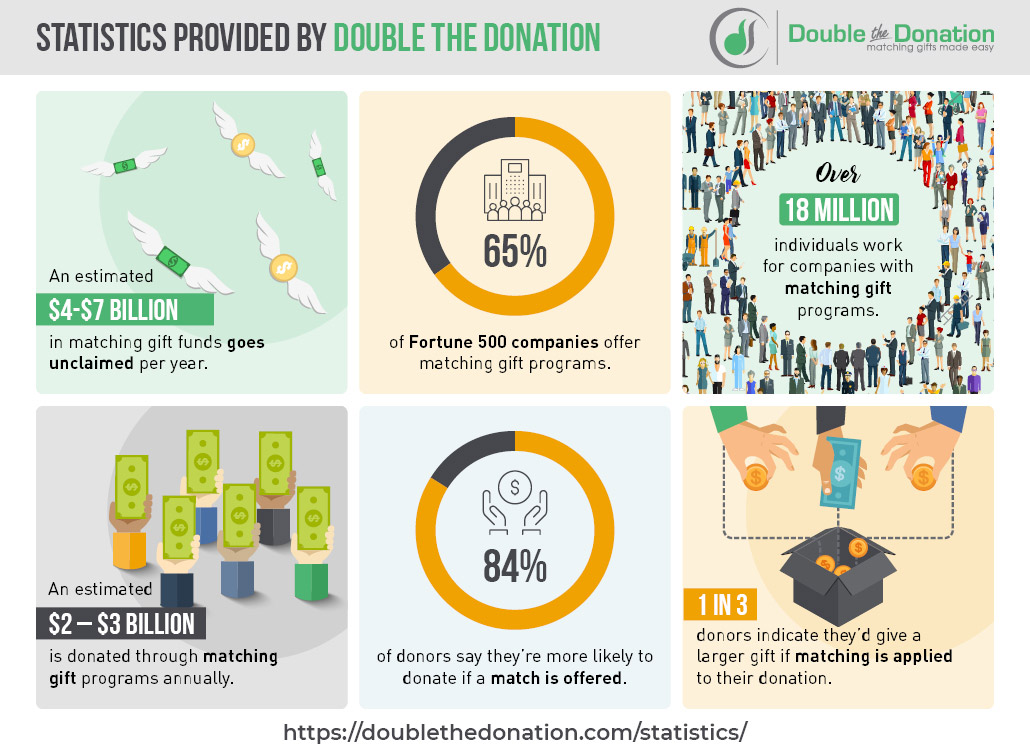

In the dynamic landscape of nonprofit fundraising, an avenue that often remains underutilized—to the tune of $4 to $7 billion each year—is corporate matching gifts. But as more and more companies continue to recognize the importance of giving back to their communities, the opportunity continues to grow.

That means now is the perfect time to rethink and refresh your efforts accordingly.

Not sure where to get started? We’ve got you covered! In this blog post, we aim to demystify the world of corporate matching gifts. And we’re doing so by providing you with a comprehensive guide that addresses some of the most-asked questions from your fundraising peers!

These are the questions we’ll cover:

- What Are Corporate Matching Gifts?

- Which Nonprofits Qualify For Corporate Matching Gifts?

- What Are Matching Gift Program Guidelines?

- Why Are Corporate Matching Gifts Important?

- Which Companies Offer Corporate Matching Gifts?

- How Can I Determine if a Company Matches Gifts?

- What Are Custom or One-Off Matching Gift Programs?

- How Do Nonprofits and Schools Collect Matching Gifts?

- How Do Donors Request Matching Gifts?

- Why Are Matching Gift Funds Going Unclaimed?

- How Can Nonprofits Market Matching Gifts?

- What Are Some Nonprofits That Benefit From Matching Gifts?

- How Do Matching Gifts Improve the Donor Journey?

- How Does Matching Gift Automation Help Nonprofits?

- How Do Matching Gifts Work With Fundraising Events?

- What Are Other Types of Corporate Giving Programs?

- How Can My Company Start a Matching Gift Program?

- How Can Employers Manage Their Matching Gift Programs?

- Where Can I Learn More About Corporate Matching Gifts?

If your organization is seeking a fundraising boost, matching gifts might be exactly what you need. And when fundraising professionals like yourself take a proactive approach to securing matching gifts from eligible donors, the results can be paramount.

At the end of this guide, you should be in a better position to effectively raise funds with matching gifts for your cause. So, without further ado, let’s get these questions answered!

1. What Are Corporate Matching Gifts?

At its core, a corporate matching gift is an amount of funding a company contributes to a nonprofit or educational institution in response to an employee’s donation to the same organization. Generally facilitated through established corporate philanthropy programs, employees who work for participating companies are incentivized to give back in order to make a positive impact and support their favorite causes. Then, their donations are doubled by their employers to make an even greater impact on the organizations’ missions.

In order to take part, eligible employees typically complete a separate request process outlined by their employers to secure a match on behalf of the organizations they’ve supported.

2. Which Nonprofits Qualify For Corporate Matching Gifts?

The types of organizations that qualify for matching gifts can vary from one company to the next. As a result, there’s no one-size-fits-all answer to this question.

It does help to note that, in general, most nonprofits and public educational institutions are eligible to receive corporate matching gifts. Still, companies often have specific policies surrounding the organizations to which they will match gifts, so it’s important to ensure your donors understand this.

When it comes to matching gift eligibility criteria, nonprofit causes are generally categorized as such:

- Educational institutions, such as universities, colleges, and K-12 schools.

- Arts and cultural organizations, such as museums, zoos, theaters, or orchestras.

- Community organizations, such as animal shelters, homeless shelters, and child welfare programs.

- Environmental organizations, such as conservation efforts, national parks, or wildlife preservation programs.

- Health and human services, such as hospitals, substance abuse programs, or community health centers.

And the above examples typically do qualify for corporate match initiatives.

However, some companies opt to match donations only to causes within specific verticals. For example, a conservation-focused business might roll out a targeted program in which it matches donations exclusively to environmental nonprofits.

In terms of ineligible causes, religious and political organizations are the ones most commonly excluded. There are some notable exceptions to this rule, though, in that, despite not matching gifts made directly to houses of worship, many employers will provide matches to religiously affiliated groups, such as food banks or homeless shelters.

3. What Are Matching Gift Program Guidelines?

Apart from the kinds of nonprofits that qualify, most companies also enact specific guidelines regarding the gift itself. These often include employee eligibility, donation amounts, submission deadlines, and match ratios.

Employee Eligibility

Employee Eligibility

Employee eligibility refers to the types of team members who qualify for matching gifts. These are primarily divided into three distinct classifications: full-time, part-time, and retired employees.

However, some companies break things down even further. For example, a few businesses offer executive-level match programs accessible only to those in their upper management teams. Meanwhile, in other cases, gifts made by an employee’s spouse will qualify, too!

Donation Amounts

Donation Amounts

When a company agrees to match gifts, it typically establishes a specific range between which matchable donations must fall. While this, too, varies by employer, industry standards indicate that the average qualifying threshold ranges from $34 to $3,728 per person per year.

If a donor contributes an amount below their company’s minimum, it won’t qualify to be matched. (That is, unless the individual gives additional funds to reach or surpass the lower end of the threshold.)

And if an individual gives more than their employer’s maximum amount, it will only be matched up to the annual limit.

Program Deadlines

Program Deadlines

It’s also important for donors to know when their match requests should be submitted. Even your match-eligible donations don’t stay matchable forever!

Generally, submission deadlines are structured in one of four ways:

A set number of days or months post-donation. A company might specify that gifts are eligible for a company match up to 3 months, 180 days, one year, etc., following a donation. This type of rolling deadline means employees of the same company who give at different times will have different dates by which they must submit their matches.

End of the tax season. An employer may also choose to set its deadline according to its tax season. If the company’s fiscal year ends on the last day of June, it could require team members to submit their match requests by this date.

End of the calendar year. Programs based on the calendar year mean that employees must request matches from their employers by the end of the year (i.e., December 31) in which the initial donation was made.

End of the calendar year with a grace period. Finally, companies that establish grace periods for their matching gift deadlines require employees to complete their match requests a month or two into the year following the one in which their initial gift was contributed. Such grace periods may extend through the end of January, February, or even March but rarely go later into the year.

Match Ratio

Match Ratio

A matching gift ratio determines the amount a company contributes in relation to their employee’s initial gift. The most common giving rate is 1:1, or an equalF dollar-for-dollar ratio. In this case, if a donor gives $25, their employer supplies an additional $25 for a total value of $50.

However, companies can establish their ratios anywhere between .5:1 (i.e., 50 cents on the dollar) and 4:1 ($4 corporate dollars for every $1 individual dollar contributed). In terms of that initial $25 gift, a match could make it worth anywhere between $37.50 and $125!

Meanwhile, match ratios can also vary from one employee to the next. For example, a part-time salesperson might qualify for a .5:1 match ratio, while the CEO of the same company can request a 2:1 donation—or triple match.

Again, it all comes back to the company’s matching gift guidelines. Looking for a way to make it easier for donors to find their companies’ program policies? Jump to our automation section below!

4. Why Are Corporate Matching Gifts Important?

Corporate matching gifts should constitute an integral part of any nonprofit’s fundraising strategy.

Why? They essentially provide free money for your organization! Who doesn’t want that?

However, a lot of organizations aren’t able to devote time or assets to building their matching gift revenue. In fact, research shows that approximately 80% of fundraisers reported difficulty establishing strong corporate giving strategies with limited staff and resources. And this difficulty directly contributes to the $4-$7 billion in matching gift funds going unclaimed each year.

That’s a lot of money left on the table!

And, when positioned well, matching gifts can have a big fundraising impact in terms of individual and corporate engagement alike. That’s not to forget the benefits for companies and their employees, either!

How Matching Gifts Improve Donor Retention

When you keep donors coming back, your organization can continue building meaningful relationships—and soliciting their support. Lucky for you, matching gifts allow you to demonstrate how you maximize supporters’ generosity to make a greater impact on your cause. Plus, informing donors about matching gifts also helps keep your organization at the forefront of their minds.

If that sounds good, here are some of our top recommendations to increase retention with matching gifts:

- Send a matching gift appeal immediately following the donation (or within the next 24 hours) to remind donors about the opportunity.

- Thank your donors after they indicate that they’ve submitted a match request to their employers.

- Update (and show your gratitude to) donors when your organization receives the completed company match.

And on a larger scale, be sure to use your organization’s giving statistics to demonstrate the impact matching gifts make for your cause! Sprinkle in value-driven statements like “Matching gift donors provided an additional $10,000 for our programming this year” or “Thanks to a generous match from Suzie G. at Home Depot, we were able to supply 1,000 extra meals to families in need!”

Other Benefits for Nonprofits

But that’s not all! There are even more ways nonprofits can benefit from matching gifts. These include:

Additional fundraising revenue. Matching gifts turn one donation into two without asking donors to reach back into their wallets! This can significantly increase your nonprofit’s revenue by providing access to corporate philanthropy opportunities.

Heightened conversion rates. Research shows that 84% of survey participants report a greater likelihood of giving if a match is offered. This result? Donation appeals that incorporate matching gifts see a 71% increase in response rate. And that’s even without accounting for the corporate funds that come after!

Increased gift amounts. The same studies indicate that 1 in 3 donors will give a larger gift if they know a match will be applied. And it leads to a 51% increase in average donation size for your organization! In other words, more money all around.

More frequent donations. Donors will be inspired to give more often if they know their donations will be matched. Nonprofits can build on new and existing relationships with donors by promoting matching gifts and encouraging more supporters to establish recurring donations, too.

Benefits for Companies

Companies match employee gifts for a number of reasons. Here are a few key ways that these programs give companies a helpful boost:

Increasing corporate social responsibility. Matching gifts offer an easy way for companies to take part in CSR efforts. And nowadays, employees and consumers alike are demanding social responsibility from the companies they work for and buy from.

Driving employee engagement. When a company establishes a philanthropy program, its employees will be more likely to get involved. This, in turn, strengthens employee engagement, increases workforce productivity, and decreases staff turnover and associated costs.

Improving brand reputation. Consumers like to know that the businesses they support are doing their part to give back to the world around them. Consumers like to know that the businesses they support are doing their part to give back to the world around them.

Providing tax incentives. The IRS notes that donations to eligible 501(c)(3) nonprofits are tax-deductible—and that includes matching gifts. As a result, companies can deduct the sum of the matches they fulfill from their total reported income, meaning they won’t have to pay taxes on the donated money. And matching gifts are exempt from the standard 10% limit, too, meaning companies can further reduce their taxable income.

Benefits for Donors

Donors also benefit largely from matching gifts. For example, they can:

Increase the impact of their donations. That much is obvious! Individual donations can go twice as far without the donors themselves supplying additional funds.

Forge stronger connections with nonprofits they support. Donors can create stronger relationships with the charitable organizations they trust, support, and care about. They tend to feel like a more integral part of the team!

Establish trust with their employer. Donors who partake in matching gift programs are more likely to build trust with their employers. Not only do they feel good about their own contributions, but they’re proud of their company for donating, too.

5. Which Companies Offer Corporate Matching Gifts?

There are a lot of corporate matching gift programs out in the world. In fact, more than 65% of the Fortune 500 match employees’ gifts. Not to mention the tens of thousands of smaller and mid-sized companies that follow suit!

That said, here’s a snippet of some of the awesome matching gift programs out there. These five companies offer generous match amounts for a variety of employee and mission types:

Top Matching Gift Company: Apple

Top Matching Gift Company: Apple

Apple matches donations to nearly any 501(c)(3) nonprofit organization. Here’s the program breakdown:

- Nonprofit eligibility: All kinds of organizations qualify for matching gifts through this program!

- Match ratio: 1:1

- Employee eligibility: All full-time and part-time employees qualify for a 1:1 match, but retired employees are no longer eligible.

- Gift amounts: Minimum of $1; maximum of $10,000

- Deadline: Matching gift submissions are due 1 month after the initial donation is contributed.

Learn more about Apple’s matching gift program!

Top Matching Gift Company: Google

Top Matching Gift Company: Google

Google also has a pretty standout matching gift program, offering multiple ways to get involved and supporting most nonprofit causes. Here’s how it works:

- Nonprofit eligibility: Most nonprofits qualify for Google’s matching gift program.

- Match ratio: 1:1

- Employee eligibility: Full-time and part-time employees can request a 1:1 match, but retired employees no longer qualify.

- Gift amounts: Minimum of $50; maximum of $10,000

- Deadline: Match requests should be submitted by January 31 of the year following the one in which the initial donation was made.

Learn more about Google’s matching gift program!

Top Matching Gift Company: GE

Top Matching Gift Company: GE

In 1954, GE launched the world’s first-ever matching gift program: the GE Foundation’s Corporate Alumni Program. This initiative matched employees’ donations at a 1:1 ratio as a way to build a culture of charitable giving among its workforce.

The GE program is still thriving to this day, and they have raised more than $1.3 billion to support a wide range of nonprofit causes.

Let’s break down the specifics of the GE program:

- Nonprofit eligibility: Though it started as an education-exclusive match, all kinds of nonprofits qualify to receive funds today.

- Match ratio: 1:1

- Employee eligibility: All part-time, full-time, and retired employees are eligible.

- Gift amounts: Minimum of $25; maximum of $5,000

- Deadline: Submissions must be sent in by April 15 of the year following the donation date.

Learn more about GE’s matching gift program!

Top Matching Gift Company: IBM

Top Matching Gift Company: IBM

IBM is a great example of a company with more narrow criteria regarding the types of nonprofits to which the company will match donations.

Here’s a breakdown of the program:

- Nonprofit eligibility: IBM matches gifts to educational institutions, hospitals and other healthcare organizations, cultural groups, and environmental nonprofits.

- Match ratio: Current employees qualify for a 1:1 match, while retired employees can request matches at a .5:1 rate.

- Employee eligibility: All part-time, full-time, and retired employees are invited to participate.

- Gift amounts: Minimum of $25; maximum of $5,000 per institution (for a total of $10,000 per year)

- Deadline: Match requests should be completed within 1 year of the donation date.

Learn more about IBM’s matching gift program!

Top Matching Gift Company: BP

Top Matching Gift Company: BP

BP is another example of an excellent matching gift initiative. And, in addition to gifts made directly by an employee, its match is inclusive of funds raised by an employee in a peer-to-peer fundraising campaign.

Here’s how it works:

- Nonprofit eligibility: BP gives to STEM educational institutions, economic development organizations, environmental nonprofits, and select other causes.

- Match ratio: 1:1

- Employee eligibility: All full-time and part-time employees are eligible for a 1:1 match, but retired employees are no longer eligible for the program.

- Gift amounts: Minimum of $25; maximum of $5,000

- Deadline: Employees should log into the company’s corporate giving platform for more details on deadlines and submission practices.

Learn more about BP’s matching gift program!

Pro tip: Looking for even more of the top companies that match donations? We’ve compiled a list!

6. How Can I Determine if a Company Matches Gifts?

Luckily, you don’t have to keep track of all the companies that match donations on your own. There’s software that will do it for you!

Take this example: Let’s say you come across a company that employs one of your top donors, but you don’t know whether it offers a matching gift program. Now, you’re wondering how you can locate this information.

There are a few different routes you can take, but utilizing a matching gift database is the most efficient and user-friendly method.

What Is a Matching Gift Database?

A matching gift database houses information on various companies and their matching gift programs. And it will generally include links to matching gift request forms, minimum and maximum amounts, match ratios, employee and nonprofit eligibility, and more.

These extensive stockpiles of corporate giving information can supply details regarding tens of thousands of different companies’ match initiatives. So, more than likely, your donor’s employer will be included—and gathering the information you need this way allows you to streamline the process for both your team and your donors.

However, if information regarding a company is not available in a corporate giving database—or your organization has yet to invest in one—your best bet would be for the donor to check with their employer. If a program is offered, details will likely be available on the company’s website, within an office policy handbook, or directly from the HR department.

(Hint: Double the Donation’s matching gifts database is the most comprehensive solution. And it covers more than 99% of companies with matching gift programs!)

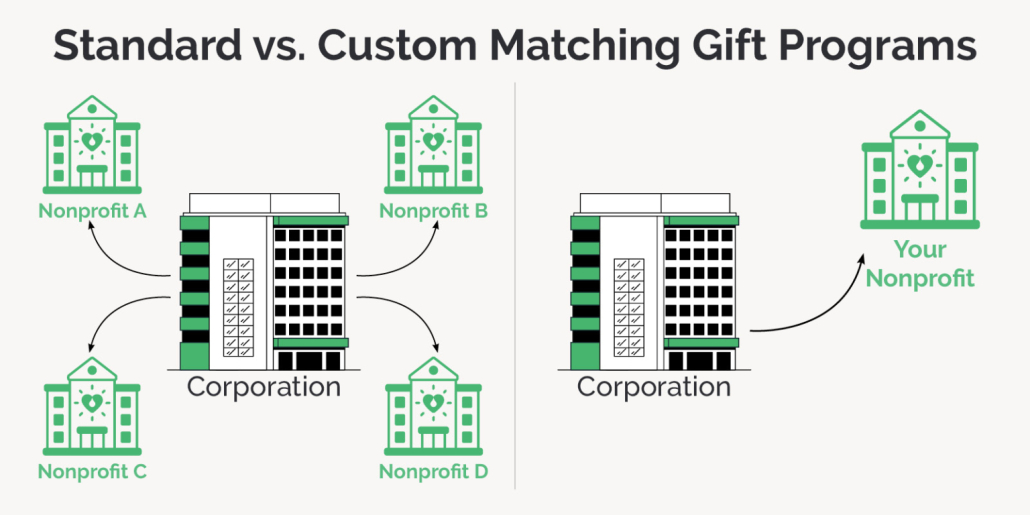

7. What Are Custom or One-Off Matching Gift Programs?

In a typical matching gift program, a company agrees to match donations its employees make to any eligible cause. A custom matching gift program takes a more tailored approach.

Here’s how it works: A company offers a custom matching gift program in partnership with a single nonprofit it wishes to support. The company then encourages employees to donate to the specific organization, pledging to match team members’ gifts as an incentive for their involvement.

This allows companies to focus their philanthropic efforts on a cause aligned with their values, fostering a deeper and more targeted impact within their chosen community or sector. It’s also an easy way for employers to dip their toes into matching gifts on a limited—and often more attainable—scale.

Custom matches are generally offered on a limited timeframe (such as a month) and often correspond with a related affinity month or cause-related celebration (e.g., matching gifts to the Breast Cancer Foundation for the duration of Breast Cancer Awareness Month).

Organizations that wish to pursue this type of matching gift program should do so similarly to how they would a corporate sponsorship. While it requires a more active role in a corporate partnership, it can be an excellent opportunity for expanding to new audiences and securing gifts from first-time donors!

8. How Do Nonprofits and Schools Collect Matching Gifts?

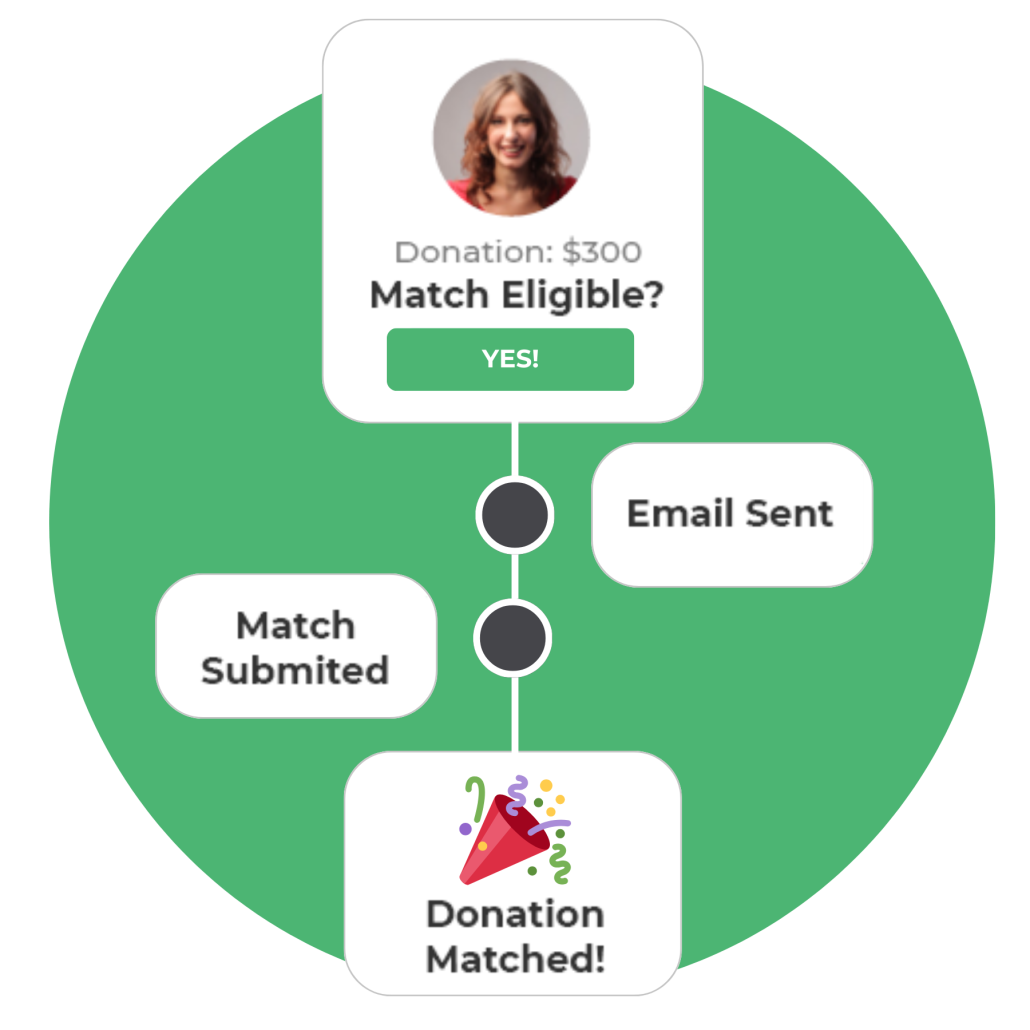

Though the specifics can differ from company to company, the overall process for matching gifts is the same across the board.

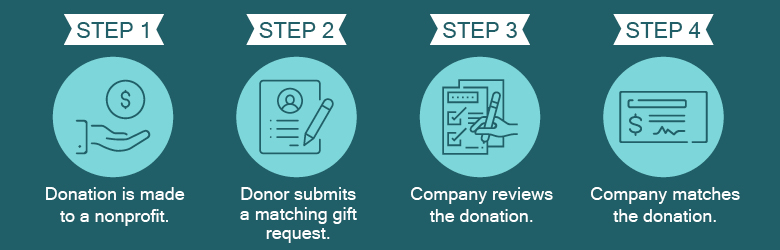

Here’s a step-by-step breakdown:

- A donation is made to a nonprofit. This first step might seem obvious, but there can’t be a matching gift without an initial gift to match. However, the donor can typically give in a number of different ways, including online, mobile, or even direct mail.

- The donor submits a matching gift request. After making the initial donation, the donor completes a matching gift request for their employer for review.

- The company reviews the donation. This is when the employer ensures the employee, nonprofit, and specific gift meet the program criteria. Once a company reviews the donation and finds that it’s match eligible, they may reach out to the nonprofit to verify the original donation.

- The company matches the donation. The nonprofit or educational institution receives a check for the matching donation!

But remember, just because the donor is responsible for kicking off the process with steps #1 and #2 doesn’t mean your team shouldn’t do its part to encourage and guide them.

Once submitted, your main role will be to verify the initial donations. For this, we recommend registering with the leading CSR platforms. This will ensure you get notified of pending gifts and can easily provide the requested information without slowing down the disbursement process!

9. How Do Donors Request Matching Gifts?

Matching gifts don’t occur naturally. In order to secure one on your nonprofit’s behalf, a donor needs to complete the process outlined by their employer to submit a request for funds. And this process, like many aspects of the matching gift experience, can vary from one company to another.

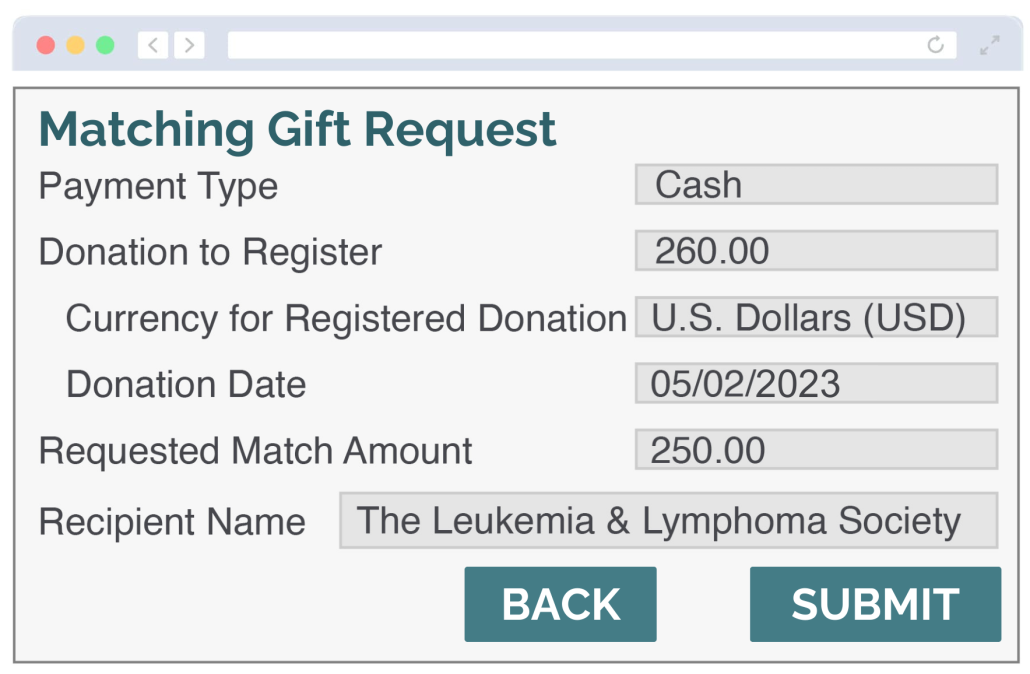

Today, most businesses prioritize digital matching gift forms, as it’s an increasingly simple way for each party to complete their portion of the task. For donors employed by these companies, the request process might look like this:

An individual makes a gift to a nonprofit cause.

An individual makes a gift to a nonprofit cause.- The individual determines (or is informed of) their matching gift eligibility and locates their company’s online matching gift portal.

- The individual fills out a digital form, provides the requested information about themselves, their recent donation, and the nonprofit recipient, and submits their request electronically.

- The company receives the request form and can review, approve, and disburse the match funds from within its CSR platform.

However, some companies continue to use paper matching gift forms. While it’s pretty rare in today’s digital age, the typical request process follows these key steps:

An individual makes a gift to a nonprofit cause.

An individual makes a gift to a nonprofit cause.- The individual determines (or is informed of) their matching gift eligibility and locates their company’s matching gift request form—either printing it or obtaining a copy from the CSR or HR departments.

- The individual completes the paper form, providing the requested information about themselves, their recent donation, and the nonprofit recipient.

- The individual mails or faxes their documentation.

- The company receives the request form, manually reviews and approves the submission, and disburses the associated match funds.

And now, companies have begun offering a new, cutting-edge method for employees to request matches with ease: auto-submission. That process, made possible exclusively through Double the Donation’s software through select CSR software integrations, generally looks like this:

An individual makes a gift to a nonprofit cause.

An individual makes a gift to a nonprofit cause.- The individual is prompted to enter their corporate email address (or another piece of identifying information) on the confirmation screen and authorizes Double the Donation to submit their request form automatically.

- The company receives the automated request form and can review, approve, and disburse the match funds from within its CSR platform.

Pro Tip: Matching gift software like Double the Donation directs donors to the correct forms to submit their requests—whether it’s an attached PDF to print and complete or a link to an online request portal.

Though some submission processes are simpler than others, it’s important to remember the task itself is not a difficult one. Plus, it’s something donors want to do in order to drive additional impact for your cause. Your supporters may just require some extra guidance from your team to complete the steps and request their matches successfully.

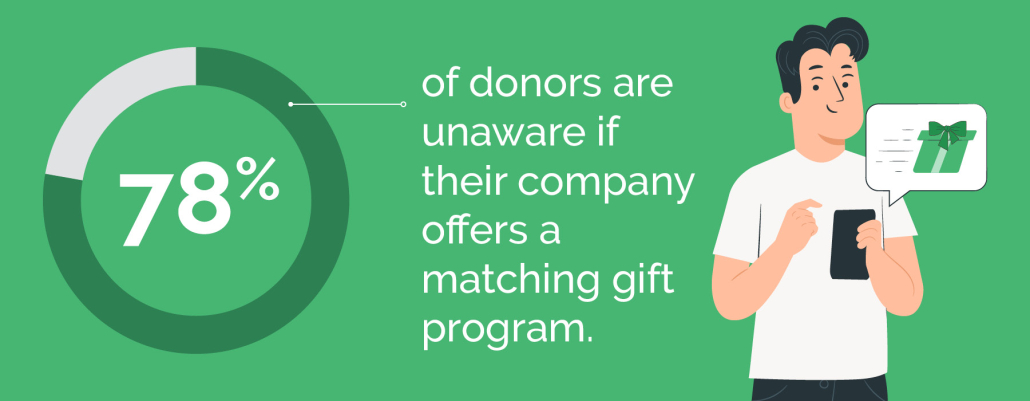

10. Why Are Matching Gift Funds Going Unclaimed?

Corporate matching gift information is often included in staff benefit packages or within a company’s policy handbook. However, employees rarely know the specifics of their matching gift programs—or even that they’re available!

This results in a significant amount of unclaimed matching gift funds being left on the table each year.

And it essentially comes down to a lack of awareness surrounding the programs. In fact, research shows that over 78% of donors have no idea if their company matches gifts. Those are donors who are not requesting matching gifts from their employers despite much of the group likely qualifying.

And it’s the exact issue that companies like Double the Donation—and organizations that are proactively promoting matching gift opportunities like those highlighted above—are aiming to address.

11. How Can Nonprofits Market Matching Gifts?

Because the biggest hurdle to increasing your matching gift revenue is lack of awareness, the obvious answer to “How can my organization maximize matching gifts?” is marketing. Plain and simple.

But what are the best ways to promote matching gifts to your audience? Here are a few of our top recommendations:

Fundraising Appeals

Fundraising Appeals

As you craft your organization’s donation asks, remember that highlighting matching gifts can elevate your appeals’ conversion rates and average gift size! Not only does a matching gift mention make your fundraising letter stand out to the recipient, but it also communicates each gift’s potential to make twice the impact.

You can even incorporate specific examples or success stories that showcase the power that matching gifts have had for your cause.

Donation Pages

Your donors are obviously passionate about your mission. Including matching gifts as part of the donation process can help donors immediately double their impact.

We suggest embedding a search tool into your donation form that collects employment data in the easiest way possible.

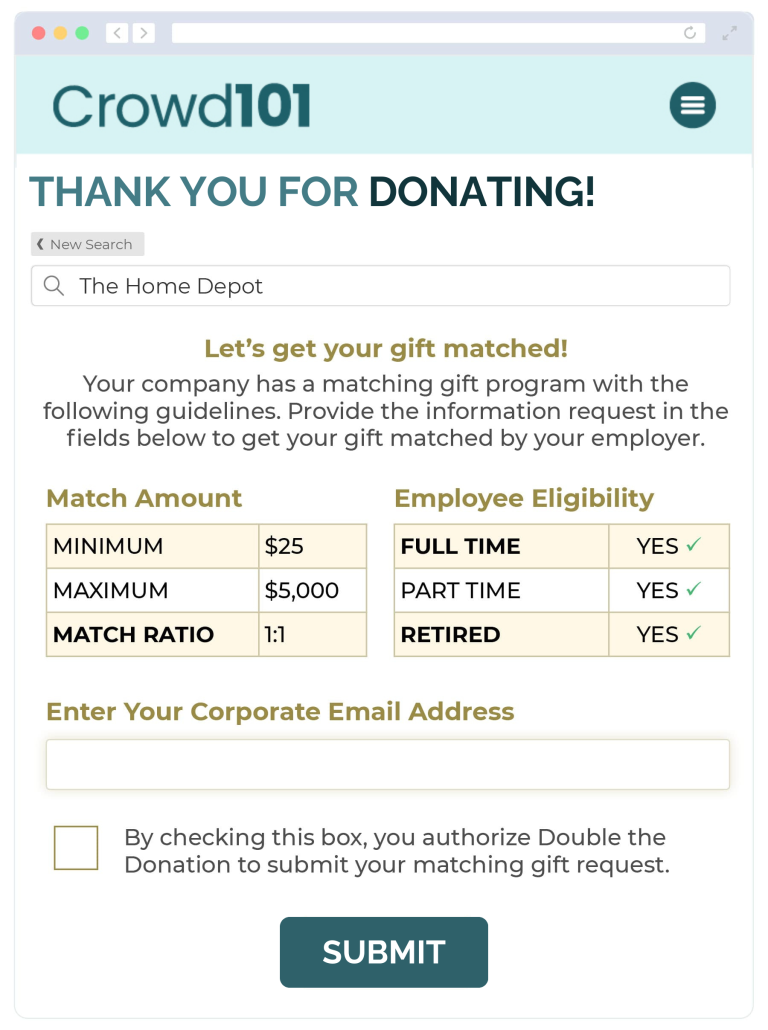

Confirmation Screens

Confirmation Screens

Just as it’s important to market matching gifts during the donation process, it’s essential to showcase the opportunity afterward, too. When you ask donors to take an additional step directly after they complete a gift, you’ll leverage the momentum from their initial engagement. It can even feel like an easy extension of the giving process itself!

Including matching gift information (including company-specific program details and forms) on the confirmation screen empowers donors to pursue a match right then and there.

Match Reminder Emails

Match Reminder Emails

Soon after a donor makes a contribution, sending a dedicated email follow-up designed to highlight the matching gift opportunity can go a long way.

Remember to express gratitude for your donors’ initial support and gently guide them through the process of checking their eligibility and requesting a matching gift from their employer. Reminder messages sent within the first 24 hours after an individual gives can be an excellent way to extend their engagement period with your organization, too!

Dedicated Matching Gift Pages

Make sure you have a page on your website devoted to all things corporate matching gifts! This should be your dedicated hub where you provide helpful information, overview the vast benefits of matching gift participation, and encourage supporters to get involved. Your match page is also a great place to embed a company search tool for donors to look up their employers’ matching gift programs on the spot.

Ways to Give Pages

Ways to Give Pages

You likely have a page on your nonprofit website that covers all the top ways supporters can get involved with your cause. Make sure matching gifts are featured prominently here as well!

Keep in mind that this section can be more condensed than your dedicated matching gifts page, but you’ll want to link out to that resource for users interested in learning more about the opportunity.

Blog Posts

Many organizations host online blogs, regularly publishing content on their websites that relates to their causes or how individuals can play a part in the mission. This is an excellent place to house in-depth information about corporate matching gifts!

You don’t have to write your content from scratch when doing so, either. The matching gift experts at Double the Donation have provided free, downloadable blog articles that your team can customize and share on your site.

Website Navigation

It hardly matters how much matching gift information your website houses if your donors and prospects are unable to locate it.

That’s why it’s important to ensure simplicity for online visitors looking to access such content from within your site. By inserting an eye-catching button or link to your matching gift page prominently in your website’s navigation, you can seamlessly direct donors to the information they need.

Social Media

With Facebook, Instagram, LinkedIn, and beyond, the world is more connected than ever. Use your social media profiles to spread the word about matching gifts and encourage donors to get involved. You can even schedule these posts in advance to ensure a regular flow of matching gift-related content!

Consider utilizing relevant and visually appealing graphics, matching gift donor and company spotlights, impact reports, and more. If you subscribe to Double the Donation’s tools, you can access a plethora of customizable social media designs within the platform, allowing users to promote matching gifts effectively with ease.

Acknowledgment Emails

Email is a quick and easy way to show your appreciation after a donor has given to your cause. And you likely already have an automated acknowledgment configured to go out after a donor gives! In addition to a separate email message devoted to the matching gift opportunity, you can also use an existing acknowledgment email to drive awareness of matching gifts.

The matching gift appeal shouldn’t be a large component of your thank-you message, but it works as a quick reminder that your donor’s gift may be match-eligible.

Newsletters

Newsletters

If your nonprofit sends regular newsletters, it’s a good practice to incorporate a section—or send a special edition—dedicated to matching gifts. Your newsletter already serves as a way to keep supporters informed about what’s happening at your organization, so why not keep them informed about this simple and impactful giving opportunity? Chances are, your supporters don’t know much about matching gifts, so educating them via your newsletter is a great first step!

Email Signatures

Email Signatures

How can you transform every email your team sends into a matching gift marketing opportunity? Just craft a simple matching gift appeal or design a relevant graphic that directs readers to your matching gifts page. Then, have your whole staff add the blurb to their email signatures!

This is one of the easiest ways you can market matching gifts, and it means that every donor-facing email you send keeps matching gifts at the forefront of supporters’ minds.

Direct Mail

People can sniff out an automated message from a mile away. That’s why direct mailings can offer a more personalized aspect to your donor outreach. You don’t have to handwrite every single thank-you letter or postcard, but signing your name at the bottom can have a huge impact, especially for donors who prefer direct mail to digital engagement.

You can also include a paper insert in your mailings that promotes matching gifts. Whether you’re sending a donation acknowledgment letter or a fundraising appeal, an insert dedicated to matching gifts can lead to a higher response rate overall.

Giving Season Outreach

Giving Season Outreach

Many donors have a tendency to give at the end of the year. But what does this mean for your nonprofit? Essentially, promoting matching gifts as part of your year-end giving campaigns—like Giving Tuesday and more—should be a priority.

Doing so encourages supporters to give and reminds them that their gifts can go twice as far!

Looking for even more ways to market matching gifts? Check out these strategies from Double the Donation

12. What Are Some Nonprofits That Benefit From Matching Gifts?

Let’s see some examples of successful matching gift marketing efforts in action! These organizations are doing a fantastic job promoting matching gifts on their websites and in their fundraising materials, ensuring supporters can easily access the information they need.

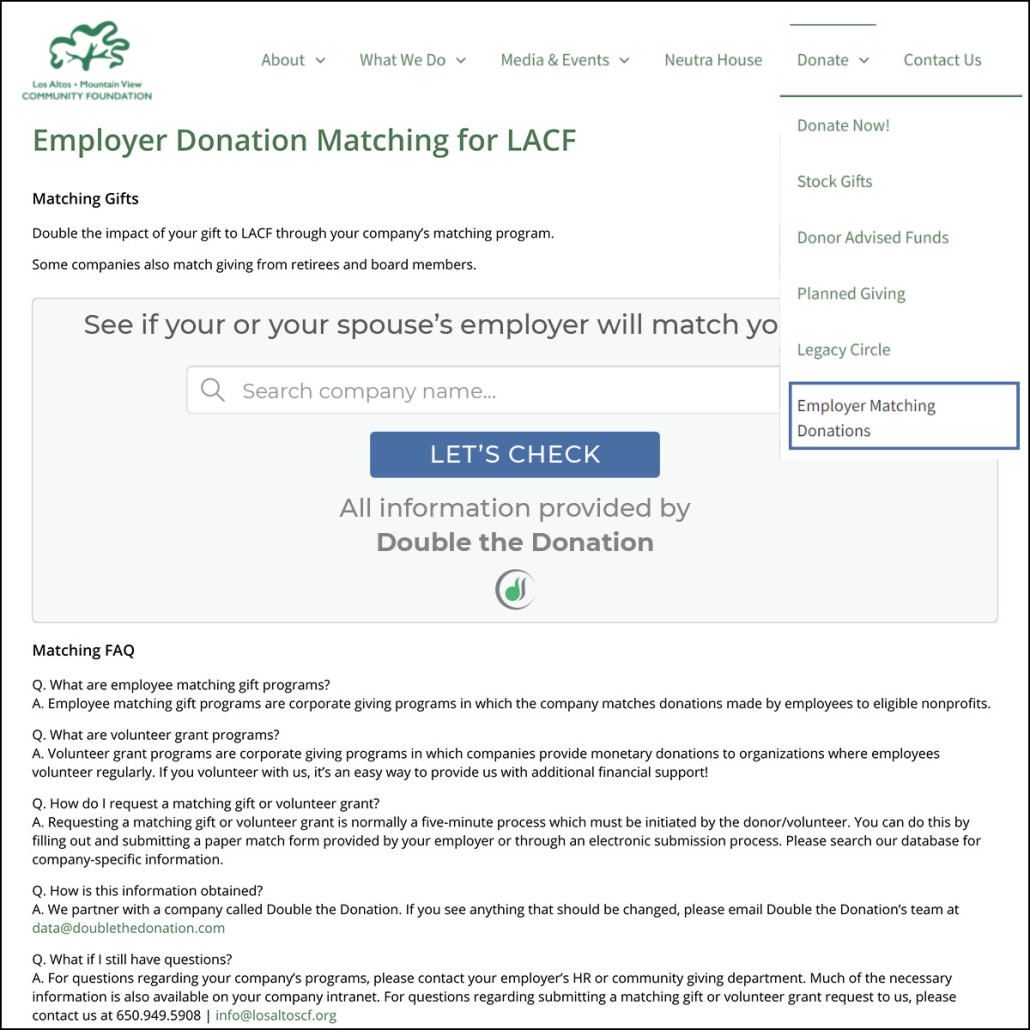

Los Altos Community Foundation

Los Altos Community Foundation encourages community building by leading and empowering residents and organizations. The organization provides grants, community-building programs, and donor-advised funds, all while addressing community issues.

The LACF also features a dedicated matching gifts page on its website, complete with a user-friendly company search tool and a Frequently Asked Questions section! This allows donors to search for their employer’s matching gift information and take the steps to get involved, and the page is easily accessible from the organization’s navigation menu.

ASPCA

The American Society for the Prevention of Cruelty to Animals (also known as ASPCA) is one of the largest humane societies in the world. It was even the first one established in North America!

Today, the organization has an innovative matching gift strategy that empowers its donors to multiply their impact. Specifically, the ASPCA directs donors to locate matching gift information from their “Ways to Give” page.

Once there, donors can view the search tool and type in their employer’s name to determine if they’re eligible for matching gifts. Plus, ASPCA helps position matching gifts as an impact multiplier by positioning the opportunity in terms of the tangible effect donors can have on the nonprofit’s mission of serving and caring for animals in need.

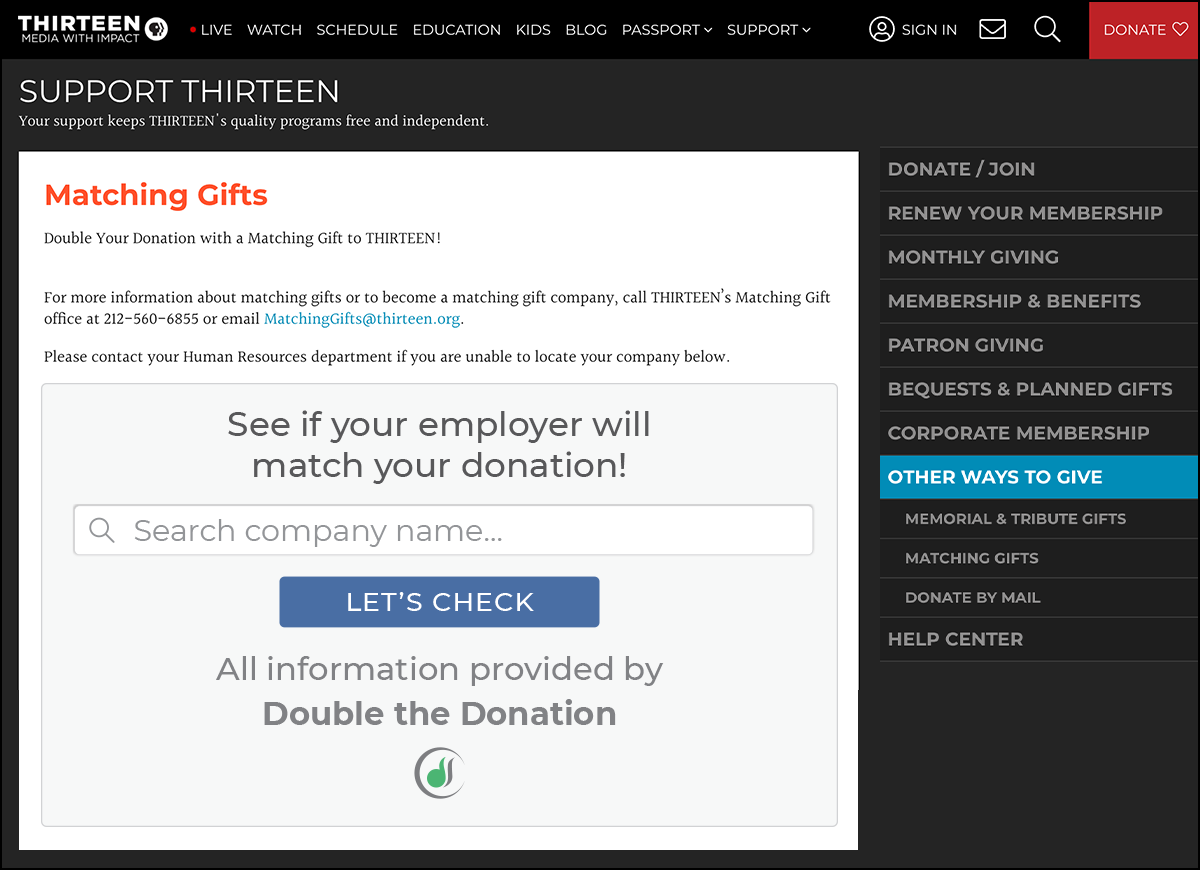

THIRTEEN

A PBS member station, THIRTEEN is a cultural and educational institution that uses television and electronic media to put on programming with a specific purpose. And its goal involves celebrating arts and culture, exploring science and nature, and encouraging everyone to enjoy learning.

In order to do so, it relies on the generous contributions of its donor base, and THIRTEEN aims to make the most of its support by pursuing matching gifts. The organization hosts a dedicated matching gift information page with an embedded company database tool and details regarding where a visitor can locate additional information.

Girl Scouts of Greater Atlanta

Girl Scouts of Greater Atlanta serves an estimated 36,000 girls and 17,000 adult members across 34 counties in the Atlanta area. The organization encourages girls to build courage, confidence, and character to make the world a better place.

And it makes it easy for its donors to make the greatest impact possible by featuring a matching gift search tool right on its primary donation page! This way, all donors are immediately presented with an opportunity to determine their workplace giving eligibility and follow the outlined steps to secure a match on the organization’s behalf.

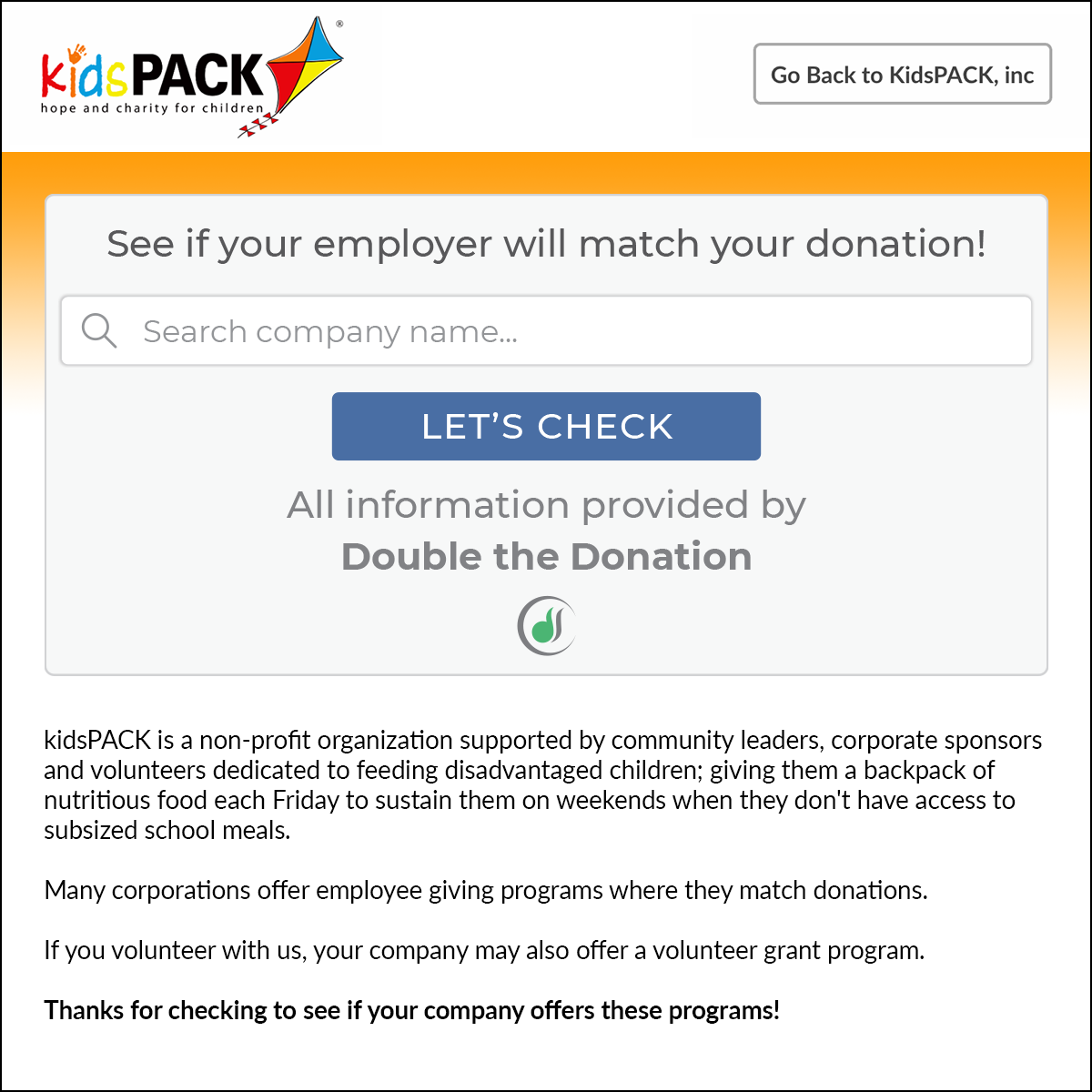

kidsPACK

kidsPACK is a nonprofit committed to improving the lives and opportunities of children, with an overall mission of ensuring no child goes hungry.

At the bottom of its main donation page, kidsPACK directs users to a corporate matching gift information page. Once donors click the prominently located link, they’re taken to the organization’s matching girl search tool and encouraged to determine their matching gift eligibility. Then, they can view even more information about matching gifts beneath it!

▼

Interested in ramping up your own nonprofit’s matching gift efforts? Take a page from these organizations’ books!

Determine which of these practices may work well alongside your team’s existing strategies, and get inspired to promote matching gift opportunities accordingly.

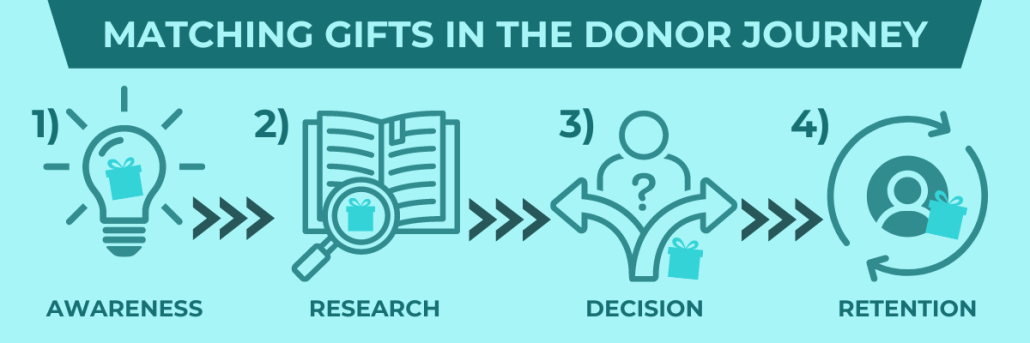

13. How Do Matching Gifts Improve the Donor Journey?

The donor journey describes the process of turning a nonprofit’s potential supporters into active, engaged, and long-term donors. It’s a vital part of fundraising success, and it helps organizations understand and connect with the individual donors who make up their supporter base.

While each individual’s journey can look different, there are four main stages at play:

- Awareness: The donor discovers a problem they want to help solve.

- Research: The donor searches for ways to help solve the problem, which often includes researching nonprofits. (Nowadays, much of this step takes place online!)

- Decision: The donor decides to contribute to a nonprofit (in this case, yours).

- Retention: The donor chooses to stay involved with your cause beyond a one-time gift.

But did you know that the process is even more effective when you incorporate matching gifts? Not only does corporate matching give donors additional ways to support your cause, but it also demonstrates amplified impact and tends to result in higher conversion rates and increased gift sizes.

This means that, for the best results, you have to take charge and promote matching gifts at the start. Here’s a breakdown of how matching gifts fit into each phase of the donor journey.

Matching Gifts in Stage 1: Awareness

Once a donor realizes there’s a problem they want to help solve, they’re already entering what is known as the “awareness” stage. Soon, prospects will look into various organizations working to address the issue, and they’ll want to select a group they believe will do the most with the dollars they contribute.

Matching gifts can help set the stage for this idea behind the scenes. And when you’ve taken a proactive approach to marketing matching gifts for your organization (such as with the Google Ad Grant!), prospective supporters are more likely to stumble across the information you’ve shared.

Matching Gifts in Stage 2: Research

Now, the real work begins! A donor or prospect at this stage will spend their time looking into various organizations and solutions that fit the problem they’ve identified. Thus, you want your nonprofit to be featured in this pursuit.

Once the individual lands on your website, you’ll want it to prominently feature matching gift information—which can be exactly what you need to make your group stand out from the crowd.

Matching Gifts in Stage 3: Decision

When it comes to this stage, you’ll actually want your donors to make two key decisions: to give to your organization and to pursue a matching gift from their employer.

As soon as a donor makes the first decision (to contribute to your nonprofit), they should be greeted with helpful resources that drive them to follow up with a matching gift, too. For example, informing supporters of the matching gift opportunity on your donation form and providing company-specific program guidelines on the confirmation page can go a long way. It even makes donors more likely to give in the first place!

Matching Gifts in Stage 4: Retention

Donors will be more likely to stay engaged with your cause if they have a good experience. And we already mentioned the fact that matching gift donors are more likely to be retained over time. Therefore, your organization should ensure the giving and matching gift processes run smoothly from start to finish.

You’ll want to demonstrate increased donation impact through matching gifts, acknowledge and appreciate donors for their support, and close the loop when your team ultimately receives the matches they request. Then, consider spotlighting matching gift donors on social media as an easy—and inspiring—way to celebrate the completed process.

14. How Does Matching Gift Automation Help Nonprofits?

It’s obviously important to raise awareness around matching gifts. But for many organizations, doing so can seem like just another thing on your plate.

So, how can your organization target matching gifts as a powerful fundraising opportunity without devoting a ton of time and resources to the effort?

Automation is the way to go. And the easiest way to do so is to invest in a dedicated matching gift automation platform!

How Matching Gift Automation Software Works

A matching gift automation tool empowers the organizations that use it to streamline the match experience for fundraisers and donors alike. And how does it work?

The process typically looks like this:

- Donor data flows into the automation system from an integrated donation form or CRM.

- The automation tool scans the provided data in order to triage records based on matching gift eligibility (likely match-eligible, likely match-ineligible, and unknown).

- The tool triggers personalized follow-up messages to donors based on their eligibility status and employment information, filling in company-specific details and providing direct links to submission forms when possible. (Hint: this step is what makes it quick and easy for donors to submit their matches—and for organizations to grow their match revenue!)

- The tool tracks match submissions to drive forward unclaimed matches, update donor records based on request status, and forecast incoming matching gift revenue.

Key Benefits of Matching Gift Automation For Fundraisers

Matching gift automation benefits nonprofits and education institutions in a number of ways. This includes…

- Identifying more matching gift opportunities. An automation platform can screen donor data to determine an individual’s matching gift eligibility based on their email domain or other provided information. Once you know who qualifies for matching, you can tailor your efforts and encouragements to scale up revenue and results accordingly!

- Removing roadblocks from the match request process. Most donors don’t know their employers match donations, let alone program criteria. Automation software helps by providing users with easy access to the information they need to participate. Donors can easily search for their employers, understand the information presented to them, and take the suggested actions to complete their requests.

- Triggering timely and personalized outreach. Organizations don’t have to worry about prospective matches falling by the wayside, nor supplying individual donors with the right information when they use an automation tool. Instead, your fundraising team can rest easy knowing the most accurate program details are being supplied according to an optimized messaging cadence.

- Driving additional matching gift revenue. Because an automation solution directs donors to the necessary forms and guidelines they need to complete their end of the matching gift process, investing in such a tool will produce more completed matches than ever before. And you’ll be happy to see the boosted matching gift revenue as a result. One study estimates that employing an automation tool increases match revenue for nonprofits by more than 61%!

- Reallocating time for top opportunities. When you automate the matching gift process for every donor, you can focus less time and resources on small-dollar matches. Instead, this tool allows you to refocus and prioritize your team’s efforts on your highest-value opportunities.

Our Recommended Solution: 360MatchPro by Double the Donation

To help you out, the Crowd101 team has previously reviewed the top matching gift software providers, offering in-depth assessments of each platform to guide and inform your buying process. And our recommended solution is Double the Donation’s 360MatchPro—an automation tool designed to scale up matching gift fundraising significantly without requiring a ton of team time and effort.

Built around Double the Donation’s industry-leading matching gift database, this tool seamlessly incorporates matching gifts into the donation experience, identifies eligible transactions, provides donors with company-specific matching gift criteria and forms, and tracks matches to completion.

Plus, 360MatchPro offers the most widespread partnership options (by far), offering native integrations with nearly 100 top donation tools, peer-to-peer fundraising platforms, and nonprofit CRMs. That means regardless of what existing technology your team uses, you’ll have the best odds of connecting your tools to Double the Donation. And in doing so, establish matching gifts as a seamless component of your donors’ giving experiences.

Learn more about 360MatchPro by Double the Donation

15. How Do Matching Gifts Work With Fundraising Events?

When you think of matching gifts, you likely picture individual contributions being matched for your cause. But what if your organization raises money from other types of fundraising campaigns—including ones that go beyond direct donations?

For many nonprofits and schools, this includes peer-to-peer fundraising events like these:

- Runs

- Walkathons

- Ride events

- Other “thon-style” events

- And more!

And believe it or not, there’s a wide variety of campaigns and events that do qualify for matching gifts. It typically just depends on the companies your donors work for.

So, how exactly do matching gifts factor into fundraising events?

It’s pretty simple, actually! These corporate donations are called fundraising matches.

Fundraising matches are similar to matching gifts in that companies contribute funds to the organizations their staff support. In terms of a fundraising event match, however, these are gifted according to the funds an employee raises—through sponsorships, fulfilled pledges, or other donations—rather than the funds an employee donates themselves.

Companies That Offer Fundraising Matches

Don’t delay in finding out more about the companies your event participants work for. While not all matching gift companies offer these types of programs, encouraging your event participants to look into the opportunity can pay off greatly. (And if you’ve invested in matching gift software, your database tool should contain information regarding these programs, too!)

Here are some examples of companies that offer fundraising matches:

State Street Corporation

State Street Corporation

As a way to incentivize employee giving, State Street Corporation offers a generous fundraising match program known as CollectMore. Through this initiative, employees are encouraged to participate in peer fundraising events, where the company matches the sum of an employee’s fulfilled pledges and other donations gathered.

When combined with State Street Corporation’s standard matching gift program (which is called GiveMore), there’s a maximum request limit of $10,000 per employee per year.

Learn more about State Street Corporation’s fundraising match program!

Penguin Random House

Penguin Random House

Penguin Random House supports its employees in giving back through its fundraising match program, matching donations up to $1,500 per employee annually. This program actively promotes employee engagement in various fundraising events, such as walkathons, bikeathons, and 5Ks.

It’s important to bear in mind that for nonprofits to qualify for this initiative, they must adhere to the company’s guidelines and possess 501(c)(3) tax-exempt status.

Learn more about Penguin Random House’s fundraising match program!

Intuit

Intuit

Intuit also offers a generous fundraising match program, enabling employees to request company matches when they engage in qualifying fundraising activities. Specifically, the company commits to matching all the funds personally raised by an employee for events like walks, runs, or rides.

Inclusive of individual matching gifts, Intuit allows employees to request a maximum of $5,000 per team member each year. This approach ensures that employees can amplify their impact through personal donations and event participation alike.

Learn more about Intuit’s fundraising match program!

Pro Tip: Don’t forget that those who sponsor your event participants’ efforts may also qualify for matching gifts through their employers.

If the donor and the fundraiser each work for companies with matching gift and fundraising match programs, respectively, you have the potential to multiply funds from both sides of the equation.

16. What Are Other Types of Corporate Giving Programs?

Matching gifts and fundraising matches are not the only types of corporate giving programs out there. In fact, there are tons more ways that companies of all shapes and sizes can support organizations like yours!

As an added bonus, we’ve outlined a few of the most common kinds of corporate philanthropy from which your team can benefit:

Volunteer Grants

Also known as Dollars for Doers, volunteer grants are awarded to nonprofits by a company where employees regularly volunteer. In order to receive a volunteer grant for the nonprofit, the employee must meet certain threshold requirements, including a minimum amount of hours volunteered. This is a great opportunity for boosted revenue when your organization has a dedicated group of volunteers!

Pro Tip: Many matching gift databases (Double the Donation’s included) also incorporate information about corporate volunteer grants!

Automatic Payroll Deductions

Automatic payroll deductions are one of the easiest workplace giving programs—from the donor’s side and the nonprofit’s side. Generally, employees arrange to have a portion of their pay deducted and contributed to a nonprofit of their choice. It’s done automatically and according to a regular schedule (e.g., monthly, once per paycheck, etc.), making it a quick and painless way to give.

Companies typically limit the organizations that are eligible, but it’s a great way for qualifying nonprofits to receive consistent and sustainable support. After all, it’s essentially a recurring donation facilitated through a company’s workplace giving platform!

In-Kind Donations

In-kind donations are another impactful way for companies to partner with nonprofits in a particularly tangible way. Rather than donating funds directly, a business will donate its goods or services to an organization it (or its employees) wants to support.

Gifts-in-kind can come in a lot of different forms, too. This might include project materials, specialized services (think: accounting, marketing, legal), event supplies, rental space, food items, and much more.

Learn about even more corporate giving programs here!

17. How Can My Company Start a Matching Gift Program?

If your company wants to develop a matching gift program for the first time, congratulations! This can be a complex process, but the rewards are plentiful.

To get started, we recommend following FundraisingIP’s step-by-step walkthrough to implement your matching gift program. Here’s a summary of the key steps it outlines:

- Set minimum and maximum donation amounts per employee per year. These tend to fall around $25-$50 for the lower limit and $3,000-$4,000 for the upper.

- Choose a matching gift ratio. The vast majority of companies match employee donations dollar-for-dollar, while others might select a lower (i.e., 0.5:1) or higher (2:1, 3:1, or even 4:1) ratio.

- Determine which employees (full-time, part-time, retired) and causes (education, environmental, health and human services, arts and cultural, religion, civic and community, etc.) will qualify to receive match funds.

- Establish a submission process and timeframe. Nowadays, most companies offer an online request form and require completion within a set number of days or months of the initial donation. However, many employers align their deadlines with the end of the calendar year.

- Decide which tools you’ll use to manage your program. There are a number of excellent corporate giving management solutions designed for companies of all shapes and sizes. Explore your options and make a decision on the platform in which you’ll host your program.

- Advertise your program to employees (and share information regarding your program policy). The more employees participate, the greater the benefits will be for your company. Thus, you want to ensure your workforce is aware of the opportunity and encouraged to get involved.

- Add your program to Double the Donation’s comprehensive database to ensure employees can easily locate the information they need. When your staff gives to organizations that use Double the Donation’s tools (which include many of the nation’s largest nonprofits), they’ll be provided with your program criteria and forms for easy submission!

Once you’ve followed these steps, your company will be on track to make a big impact—internally and externally—by supporting your employees’ charitable endeavors and giving back to the community as a whole.

Keep in mind that you don’t have to offer the best matching gift program right out of the gate. Start where you can, collect feedback from employees, and see what you can do to continually develop your giving initiative from there

Pro Tip: Looking for your company to establish a matching gift program, but you’re not the decision-maker on the subject? Check out this helpful guide that walks through the steps a team member can take to advocate for a matching gift program to their employer.

It even includes a handy email template so you can pitch the idea to your boss with ease!

18. How Can Employers Manage Their Matching Gift Programs?

For companies that offer corporate matching gifts, managing their giving programs effectively can be a hassle. Just as nonprofits can benefit from matching gift software, companies that offer matching gift programs can also benefit from workplace giving technology.

Using workplace giving tools, companies can:

- Track employee donations.

- Review and/or automatically approve matching gift requests based on the company’s guidelines.

- View the overall impact employee donations are making through robust reporting tools.

Companies that leverage workplace giving software put themselves in a position to make the most of the matching gift programs in which they’ve invested.

Plus, the right platform will make it easier for their employees to participate, too. The more streamlined a company’s submission process is, the more inclined their employees will be to complete the steps, and the more nonprofits will ultimately receive in funding.

The Role of Employee Engagement Tools in Corporate Matching Gifts

If engagement in your workplace giving program is slim to none, you may need some extra help to incentivize your employees to participate. In particular, employee engagement tools can play a significant role in boosting matching gift requests. Here are the areas in which these platforms can help:

- Targeted Communications: Send tailored messages and reminders to employees who have donated but haven’t requested a match. Alternatively, encourage those who may be interested in donating based on their engagement in related activities to get involved.

- Tracking and Reporting: Track which employees participate in your matching gifts program, how much has been donated, and more. Generate reports with this data to then share with employees and other stakeholders to show the impact of their contributions. This can encourage further participation, too.

- Gamification: Incorporating gamification elements like leaderboards, challenges, or badges within your workplace giving platform can help inspire employee engagement. For example, you might challenge teams to achieve the highest participation rates by department!

- Social Sharing and Recognition: Recognize your most charitable employees and celebrate anyone who participates in matching gifts. Social sharing options within your giving portal also allow employees to spread the word and encourage their colleagues to join in.

- Feedback and Surveys: Collect feedback from employees regarding your matching gifts program. This can supply valuable input that helps your team understand and address any barriers to participation.

Get creative with how you use your software to drive program participation and grow your company’s impact. By leveraging these features, you’ll not only provide a top-notch employee giving experience, but you’ll also establish a culture of philanthropy that spreads throughout your company.

19. Where Can I Learn More About Corporate Matching Gifts?

We hope you’ve learned a ton about corporate matching gifts in this Q&A-style guide. These programs have the potential to bring just about any organization’s fundraising strategy to new heights. You just need to educate your team and your donors on the opportunity in order to make the most of it!

If you’re interested in exploring more, check out some of our favorite resources from Crowd101 and other industry experts below!

- The Matching Gift Academy. Learn everything you need to know about the matching gift industry with this online Matching Gift Academy! Access strategies to grow your matching gift success with helpful instruction from Double the Donation.

- Incorporating Matching Gifts into Your Donation Form. Featuring matching gifts during the donation experience is one of the most effective strategies your nonprofit can use. Find out how you can do so with our complete guide.

- 18 Top Matching Gift Programs Your Nonprofit Should Know. Understanding which companies offer matching gifts can help guide your team’s engagement strategy. Want to discover even more top matching gift programs? Read through our list!