Ultimate Real Estate Crowdfunding Guide for Beginners

Use this real estate crowdfunding guide to decide if the new opportunity in property investing is right for you

From commercial real estate agent to investor and landlord, I think I’ve been involved in just about every step in property investing. I’ve been investing in real estate for about as long as I’ve had money to invest and love the pride of ownership you get with real assets.

I’ve seen another type of real estate investing build momentum over the last few years and have only recently gotten active in the space.

It’s the crowd’s answer to some of the biggest problems in traditional property investing and it’s filled a big gap in my portfolio.

Whereas I used to worry about a crash in property prices within the two main markets in which I invest, I’m now diversified across five major markets and in a few smaller ones. Where I used to worry about overbuilding in residential real estate hurting the rents I could charge, I’m now diversified into office, hotel and other property types.

Real estate crowdfunding took longer to develop than other types of crowdfunding and peer-to-peer investing but it has really gained momentum this last year. The word is getting out about solid returns and instant diversification for individual investors.

I’m creating this real estate crowdfunding guide as a primer on the investment but also plan on publishing a few more guides on specific topics in property crowdfunding like how to analyze a property and how to make sure you are well diversified.

Real Estate Crowdfunding Basics

Real estate crowdfunding is the 21st century’s answer to some of the biggest problems in real estate investing for individuals.

The model is simple. A group of investors pool their money for an investment property, managed by a professional developer and then disperse the profits as is done in any partnership. A partnership agreement is written up, usually with the developer as the general partner and investors as limited partners.

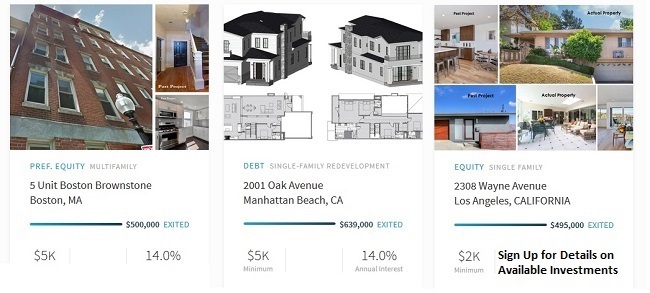

The crowdfunding part of the idea comes from the websites set up to make all this as easy as possible. Real estate crowdfunding sites like RealtyShares and Peerstreet, the two I use most often, have a staff of analysts and underwriters to verify potential investments.

Developers submit their project for review to be included on the site, including all legal and investment documents. These include the project financials and developer’s history as well as detail of the investment offer.

Vetting is strict and only about 5% of submitted projects ever make it on the platforms. After a project is approved, investors can come in with as little as $1,000 on each that meets their criteria. Once a project is funded, the developer gets to work and ownership documents are given to each investor.

You can invest in equity or debt on most real estate crowdfunding sites. Equity investments give you higher upside potential but with the risk. Most of your return is going to come when the project is completed and sold in three- to five-years. Debt investments are contractual loans secured by the property and you receive interest plus principal each month.

RealtyShares offers debt and equity investments while Peerstreet only offers debt investments. I like investing on multiple platforms because it gives me access to as many deals as possible. There’s no fee for accounts, just a 1% to 3% management fee charged by the website.

The developer remits all payments and returns to the platform which divides them up among investors according to the amount they have in the project.

The ease of real estate crowdfunding is one of its major advantages against traditional property investment. I had six rental properties at the height of my ‘real estate empire’ and it was basically a part-time job. With real estate crowdfunding, you get professional property management through the developer and from someone with a vested interest in the success of the project.

Another advantage of real estate crowdfunding for individual investors is the ability to diversify your real estate investments. It’s impossible to buy enough property types and in enough regions to get the diversification that is going to smooth market risks for less than $1 million with direct ownership.

Property crowdfunding gives you the chance to put together a portfolio of 20 properties for as little as $20,000 – including different property types and in different regions.

Real Estate Crowdfunding Returns

Most real estate crowd platforms have only operated for a few years but annualized returns are starting to come in on some of the shorter-term projects. I’ve been investing for three years and have booked returns around 9% on debt and 15% on equity projects.

I’ve also written a case study on property crowdfunding returns, surveying projects and returns on five different platforms. My experience falls right around the averages with most investors booking just under 10% on debt and 12% to 15% on blended portfolios of debt and equity. Returns as high as 20% are available on individual properties but your portfolio is usually going to smooth out to around 14% or so.

That might not sound like an amazing return worth the time to analyze individual real estate crowdfunding projects but don’t overlook some of the other benefits.

- Real estate investment is one of the best tools for diversifying a portfolio of stocks and bonds. It holds up during inflation and has a natural demand that supports prices even in a recession. Overall real estate returns have beaten stocks for decades and with about two-thirds the volatility.

- Real estate crowdfunding is a cheap and effective way to diversify a portfolio of properties, protecting you from market-specific risks.

- Property crowdfunding is one of the most passive investments I’ve seen with nothing to do but collect returns once the project has been funded.

Real Estate Crowdfunding Reviews

There are hundreds of real estate crowdfunding platforms though most get very few projects in any given month. I’ve reviewed quite a few of these crowd sites on the blog and have settled on a short list on which I invest; mostly based on deal flow and the platforms’ strength in the vetting process.

I only invest regularly on three platforms; Realtyshares, PeerStreet and EquityMultiple but there are a few others you might want to check out. Again, it doesn’t cost anything extra to have accounts on multiple sites and you’ll get access to as many deals as possible.

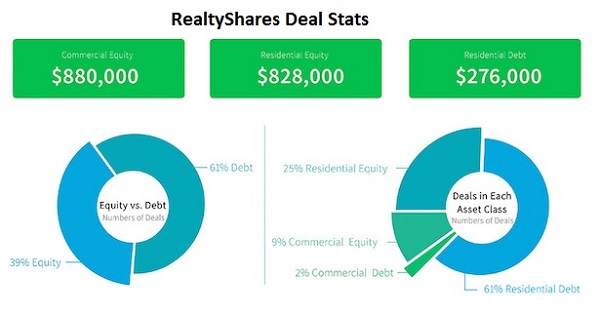

RealtyShares is one of the largest platforms and offers a good mix of equity and debt investments. The platform charges a 1% management fee to investors and has helped fund over $200 million in property. Most active markets for projects include California, Chicago and New York. About two-thirds of the projects are residential property but you can find enough deals in other property types to get a good mix.

Use promo code Partner100 to get a $100 bonus on your first investment

PeerStreet allows debt investments on the platform with historical returns ranging from 7% to 12% on terms up to 24 months. The newer platform is backed by Silicon Valley heavy-weight Adreessen-Horowitz and was named top emerging real estate platform at the LendIt Industry Awards last year.

An interesting feature on PeerStreet is the automated investing tool to keep your cash working for you. Since debt investments have principal and interest flowing in monthly, it’s extremely important to redeploy cash so it’s earning interest. With the auto-investing tool, you choose the criteria of the loans in which you want to invest and the platform will look for matches each day.

EquityMultiple is a newer property crowdfunding platform but is making a name for itself in the institutional space. Rather than the smaller, residential property projects you see on most sites, EquityMultiple only allows large commercial projects like hotels, office parks and industrial space.

The quality of properties attracts institutional money managers and other big investors so I like knowing that there is some strong due diligence going into the same projects in which I’m investing.

RealtyMogul is one of the older real estate platforms but has not listed as many projects lately other than the funds it offers on its own projects. Non-accredited investors are allowed to invest in these real estate funds but management fees tend to be high, especially compared to investing in real estate investment trusts (REITs).

My Experience with Real Estate Crowdfunding Investing

I like being able to diversify my property portfolio with crowdfunded projects. I’ve been investing on several property platforms for a few years and the process works easily into my overall investing strategy.

I’m an accredited investor but I don’t have the money or the time to manage a portfolio of real estate properties effectively. Managing more than a few properties can be a part-time job at a minimum and can be impossible if you’ve got rentals in other markets. Even a couple hundred thousand in a few property types isn’t enough to give me the kind of diversification I need that an economic hit to the region in which I invest wouldn’t be a big loss on cash flow.

So I diversify by investing in REITs and in real estate crowd projects. Just as with my portfolio of stocks and bonds, I invest in both equity and debt projects.

I try to keep my crowd portfolio invested in 15 – 25 projects. I try to keep that divided between at least three property types and in at least three different major markets across the country. Investments range from $3,000 to $5,000 in each project.

How to Get Started Investing in Crowdfunding Property

First of all, you have to decide if property crowdfunding is right for your investment goals and needs. I’ve tried to detail out this real estate crowdfunding guide and will add more as I go but your own investing strategy needs to fit with the unique opportunity.

Real estate crowdfunding offers solid returns but most projects are short-term so there is the need for constant management of your portfolio. The auto-invest tool on PeerStreet keeps my money invested but I still need to check in each month on each platform to source equity deals, analyze potential projects and follow my investments.

If you can spare a few hours each month to manage your property investments then crowdfunding can be a great way to diversify some of that risk away and still book good returns.

- Get started with a free account on RealtyShares

- The application process takes less than 5 minute though linking your bank account can take a few days to complete

- Look at your existing property portfolio to find where you need more diversification, by region or by property type

- Look for a mix of equity and debt investments that meet your diversification needs

- Make sure to review the offer documents for each project. Understand your rights as an investor and the assumptions on which the projected returns are based.

- Be prepared to lock your investment into a property for at least a few years for equity and for a year or two in debt.

The process of starting with real estate crowdfunding is only slightly more complicated than investing in stocks. Stocks have a market of millions of investors so there is usually free analysis available on any company.

This isn’t the case with property projects on crowd sites. The analysts at the platform are there to verify documents and make sure the project isn’t a scam but they can’t tell you if it’s a good investment or not.

I recommend finding at least two or three other crowdfunding investors to help break up the analysis and talk about deals. This kind of real estate investment club will take a lot of the burden off you and can help make better decisions.

Pros and Cons of Real Estate Crowdfunding

Real estate crowdfunding has a lot of advantages over traditional property investing but it isn’t without its own risks and complaints. I’ve only seen one investment fail and return nothing while a couple have returned my investment but no profits. These failed projects are rare and its even rarer that it’s a matter of scam but usually just a project that doesn’t work out.

Real estate crowdfunding has a lot of advantages over traditional property investing but it isn’t without its own risks and complaints. I’ve only seen one investment fail and return nothing while a couple have returned my investment but no profits. These failed projects are rare and its even rarer that it’s a matter of scam but usually just a project that doesn’t work out.

Pros of Real Estate Crowdfunding

- Instant diversification for a portfolio of properties as well as diversification from other risks in the stock and bond market

- Mostly passive investment with limited time needed to analyze and follow investments each month

- Low fees of between 1% to 3% on most property crowdfunding platforms

- Professional property management with an interest in success of each deal and returns of between 9% to 15%

Cons of Real Estate Crowdfunding

- Most platforms are only open to accredited investors, those with a million or more in net worth or a high annual income

- The market isn’t yet developed enough to offer much analysis so you’ll have to look over offer documents yourself

- Short-term investments mean you pay capital gains taxes more often and will lose some of your returns to taxes

Browse Available Investments Free on RealtyShares

Use this real estate crowdfunding guide to help you get started with property crowdfunding but you’ll still need to look over offer documents for each property in which you want to invest. I spend a few hours each month looking over new projects and investing in only one or two. Real estate crowdfunding offers a lot of advantages over traditional investing and is a great compliment to a portfolio of properties. Sign up for a few accounts on real estate crowd platforms to see which give you the best access to investment deals and before you start investing.