Understanding Your Finances: A Quick Guide for Nonprofits

Nonprofit professionals spend a lot of their time looking for new ways to raise money and enhance their fundraising efforts. From developing new fundraising ideas to hosting your next event, you work hard to earn the funds you need to back your mission.

But how often do you stop to consider the implications of your nonprofit finances past these attempts to raise money? A foundational understanding of broader financial management for nonprofits will help your nonprofit team make better and smarter financial decisions both during and after fundraising campaigns.

In this guide, we’ll cover some basic financial knowledge that executives, fundraising professionals, and other individuals at your organization should have for smart decision-making.

What We’ll Cover

Nonprofit finances can be a challenge for non-accounting professionals. However, the more you understand on the subject, the better prepared your nonprofit will be to handle challenges and make decisions that best support your mission. Let’s get started.

1. Fund Accounting Overview

Fund accounting is a method of accounting that focuses on accountability rather than profitability. It’s an effective accounting system for nonprofits because they must remain accountable to their donors, grant funders, and other revenue sources, recycling the funds back into the organization rather than collecting them as profit.

While for-profit organizations can consider their revenue as a whole and simply allocate money to the project, program, or initiative with the greatest need for funds. Nonprofits, meanwhile, may encounter restrictions on the funds they receive. Donors and grant funders can place restrictions on the money they donate, requiring it to be allocated to specific aspects of your nonprofit’s mission.

Therefore, when nonprofits receive funds, they need to separate them based on these restrictions. There are three main types of funds nonprofits need to use to separate and properly allocate their money:

- Unrestricted funds. These usually are donations made to your nonprofit’s annual fund. They contain no restrictions and your nonprofit can allocate these funds wherever they will do the most good. You can use these for program expenses, overhead costs, or any other expenses that your nonprofit encounters.

- Temporarily restricted funds. Temporarily restricted funds are restricted to a specific program or project. You should have an agreement with the donor about what happens to the money if that project is completed. For example, if a donor gives money to help you build a new building, what if there’s funding left over after the building is completed? Sometimes, you can arrange for this funding to be released from restriction and added to your unrestricted assets.

- Permanently restricted funds. Permanently restricted funds are those that are perpetually dedicated to the specified purpose for which they were given. For example, a major donor may give a large gift for an endowment where the interest is used for a sustained scholarship program.

Fund accounting helps nonprofits track these restrictions and ensure your organization is adhering to them properly in your budgeted and actual expenditures.

2. Bookkeeping vs. Accounting

For many individuals who don’t understand the nonprofit financial sector, “bookkeeping” and “accounting” are interchangeable terms. However, in reality, they have very different meanings and refer to different aspects of how your organization’s finances are handled.

According to Jitasa’s bookkeeping vs. accounting article, here are the primary differences between the terms:

- Nonprofit bookkeeping describes the record keeping of nonprofit organizations. Bookkeepers take care of the day-to-day financial activities at your organization such as basic data entry, writing checks, making deposits, and processing payroll. Nonprofit bookkeepers don’t typically need specialized education. However, they should understand the basics of what nonprofit finance looks like and how to use your financial software solution.

- Nonprofit accounting describes the analysis of financial records and the process of making decisions regarding the best next steps for your nonprofit. Nonprofit accountants are those who make informed financial decisions for your organization. This role requires a four-year degree in accounting, and most professionals must also be CPA-certified. Your accountant will prepare detailed financial reports, compare actual vs. projected budgets, prepare your books for nonprofit audits, and help file your annual tax forms.

For example, let’s say a donor contributes a gift in the form of a check during your nonprofit’s annual auction event. Your bookkeeper would be the person to record that donation in your accounting system. However, your accountant would be the one who pulls your statement of activities, showing the impact of the revenue earned from the event as a whole.

3. Nonprofit Budgeting

Creating an accurate and effective budget will help make sure that your organization is not only securing revenue but that you’re also making the most of the funds you secure to promote organizational growth.

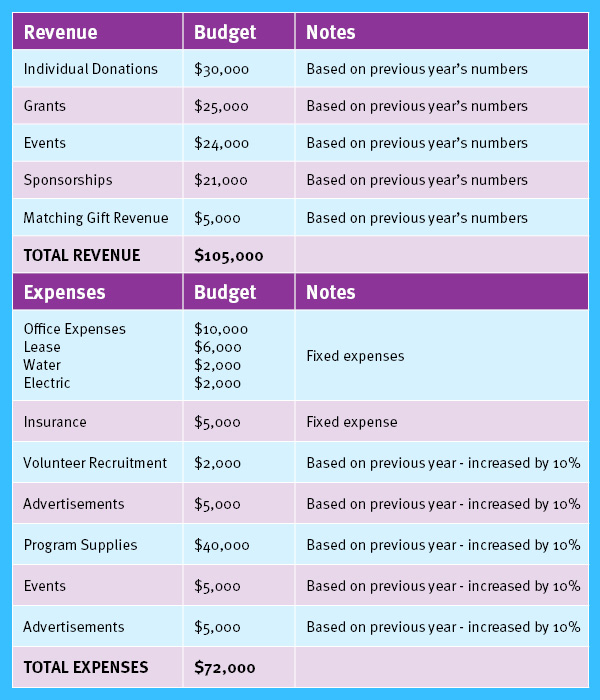

When you develop your personal budget, you might only focus on the expenses that you incur, likely because your income is fairly steady with simply one or two main sources. You have more categories of expenses than sources of income. However, nonprofits need to categorize both income and expenses for their budgets, breaking them both down into specific categories.

When you lay out your expenses, break them down into specific categories in order to make your financial organization easier. Within these categories, your nonprofit can further break down your expenses, defining them and making them more manageable. The categories you should consider include:

- Fundraising expenses. Fundraising expenses can be further categorized into the marketing, event, and tech tools that you use to reach supporters and develop relationships with them to enhance your fundraising efforts.

- Administrative expenses. Administrative expenses are those that you use to keep your doors open at your organization. For instance, employee salaries, office rent and utilities, and data organization investments would all fall under this category.

- Program expenses. Your program expenses are those that are necessary to conduct your work with the community. For example, if you work at an animal shelter, the veterinary fees and purchase of food for the rescues would be considered program expenses.

These categories also happen to be the ones that your nonprofit uses on your Form 990. This means when you review your actual budget, statement of functional expenses, Form 990, and other forms, the numbers should be consistent across each form.

When it comes to your nonprofit’s revenue, you should also consider the sources of funding that you have coming in and make a budget based on your predicted funds from those sources.

It’s better to have a conservative view of your revenue rather than an optimistic one. This helps you build your reserve fund or protect you in case the year isn’t as profitable as you expect. There are two different ways you can predict your revenue with this conservative mindset:

- The discount method. The discount method is when your team identifies the predicted revenue from each fundraising source and multiplies that number by the probability that you’ll receive the funding. For example, you may have a 90% chance of receiving your predicted grant funds, but a 75% chance of receiving your predicted online fundraising revenue.

- The cutoff method. With the cutoff method, your organization will consider the total fundraising revenue predicted and multiply it by the probability that you’ll reach that fundraising total. For instance, if you predict that you’ll receive $200,000 in fundraising, but that you have a 75% chance of receiving that predicted amount, you’ll budget $150,000 for your predicted revenue.

When you’ve predicted your annual revenue and expenses, your nonprofit’s budget will end up looking something like this:

As you can see, there are many elements that must be included in your nonprofit’s budget. It requires a very organized and financially-focused individual to put together a well-designed and effective one. That’s one reason why your accountant (rather than your bookkeeper) should play a part in creating your organization’s budget each year.

The budget will need to be approved by your nonprofit’s board of directors before it’s put to use, though. Be sure there’s open communication between the individual who will present the budget (often the executive director) and your accounting team. This way, your presenter can proactively ask any questions that the board might also have, making the approval process simple and straightforward.

4. Annual Taxes for Nonprofits

When you started your nonprofit, you took steps to make sure that you wouldn’t have to pay taxes each year. That’s one of the great things about being registered as a 501(c)(3) organization! However, you still have tax forms that you need to file each year. Your Form 990 is the annual federal form that you need to file to maintain your tax-exempt status.

Your Form 990 is essentially a way for the IRS to make sure no organizations are taking advantage of the tax-exempt status for nonprofits. So long as your nonprofit is operating with a high level of integrity, you should have no trouble when it comes to reporting your finances to the IRS.

However, if you fail to file or are late in filing your Form 990, your nonprofit will incur penalties from the government. These penalties include:

- Loss of your tax-exempt status. If your organization fails to file for three consecutive years, you risk losing your tax-exempt status. To get it back, you’ll need to re-file other forms and use a lot of your valuable time completing tedious paperwork. Plus, you’ll need to pay the fee to re-register as a 501(C)(3) organization.

- Loss of your ability to accept tax-deductible contributions. The fact that donating to nonprofits is tax-deductible is a major incentive for many individuals. Failing to provide this deductible option takes away some of the incentives for supporters to continue contributing.

- Immediate late fees. If you file your Form 990 late, you’ll incur late fees. You’ll be charged $20 per day that it’s late, with a maximum penalty of $10,000 or 5% of your gross revenue. However, if your organization generally has gross receipts of over $100,000, that penalty increases to $100 per day with a maximum penalty of $50,000.

As you can see, filing your tax forms is an immensely important part of your nonprofit’s regular financial reporting. You have the option of either filing this form on your own or reaching out to an accountant to help file it on behalf of your nonprofit.

While the Form 990 is the primary tax consideration for nonprofits, it’s not the only one. Your nonprofit should also consider the tax obligations that you have for your donors and to your contractors.

For donors, your nonprofit is required to provide receipts for donations of over $250 contributed to your nonprofit. However, it’s recommended that you provide receipts for all donations made. This allows your donors to take advantage of the tax deductions they can receive after they give.

Your nonprofit should be sure to request a W-9 form at the beginning of your relationship with a hired contractor. This provides all of the information your team needs to provide a Form 1099 for that contractor as well. This form will be necessary for contractors who earn more than $600 annually from your nonprofit to file their own personal tax returns.

Nonprofit finances can seem like an overwhelming and tricky subject. However, a fundamental knowledge of how they work and what they look like will help your nonprofit make the most of your funding. You’ll find yourself better able to invest in growth and create an even greater impact.