7 Steps to Maximize Corporate Giving Avenues for Your Org

As a nonprofit fundraising professional, are you familiar with the idea of corporate philanthropy? Do you understand how corporate revenue can significantly impact your organization’s fundraising strategy? And if so, do you have a plan in place to maximize corporate giving avenues (such as matching gifts, volunteer grants, and more) and collect maximal funding for your nonprofit and its cause?

You certainly should—and this guide is here to walk you through the process step-by-step. This includes:

- Understanding the types of corporate giving.

- Registering your nonprofit with corporate giving vendors.

- Collecting employment information from donors.

- Using a matching gift database to provide company guidelines.

- Following up with eligible donors post-transaction.

- Mentioning corporate giving opportunities in fundraising appeals.

- Communicating the benefits of corporate giving participation.

Ready to dive in and find out how to elevate your organization’s fundraising through various corporate giving avenues? Let’s begin!

1. Understand the types of corporate giving available.

To start pursuing donations, grants, and sponsorships from businesses more effectively, you first need to understand the many different forms that these gifts can take.

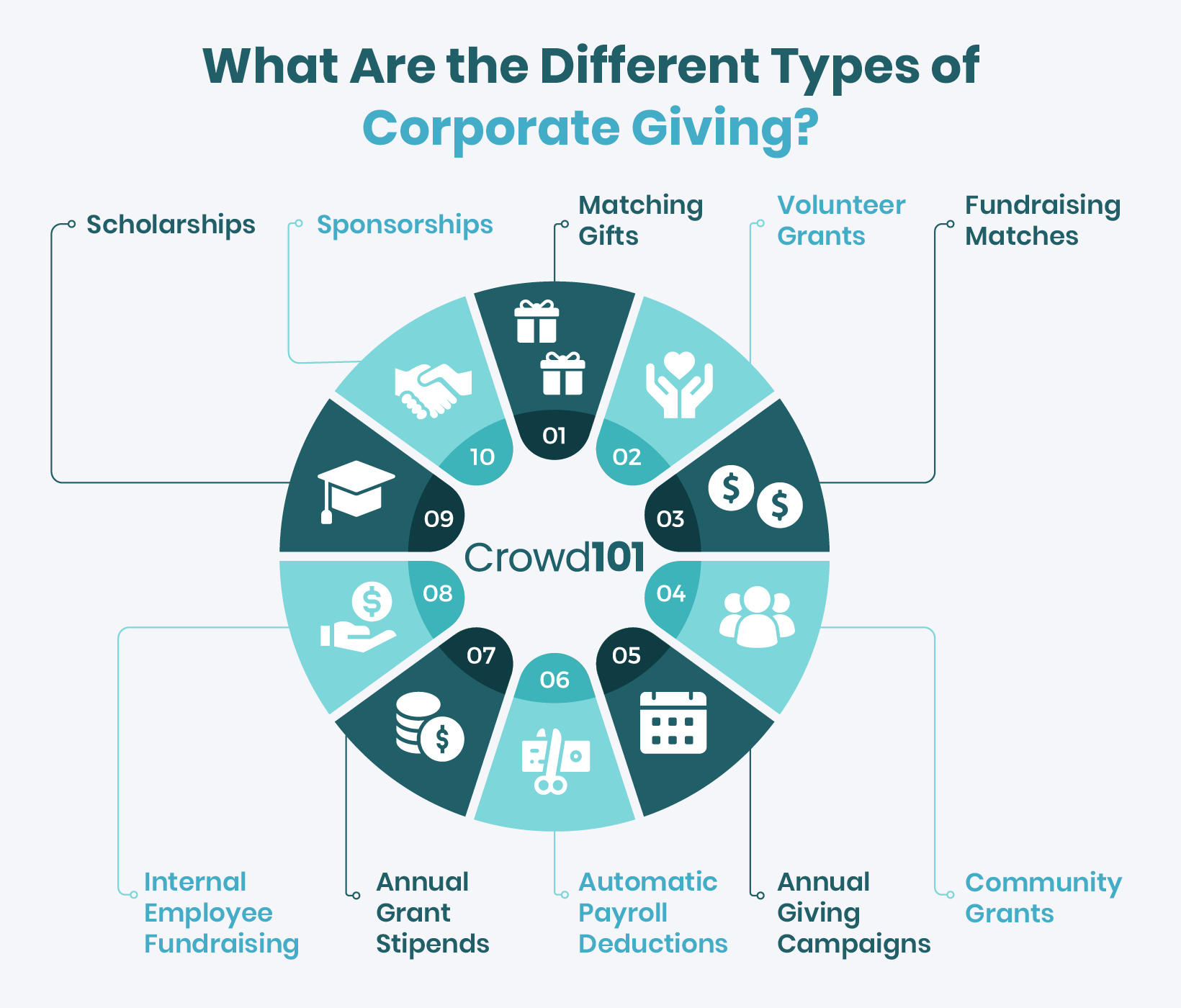

Nonprofits Source identifies 10 distinct types of gifts that businesses provide to nonprofits in its guide to corporate giving:

- Matching gifts. These popular and easily-administered corporate social responsibility programs involve employers financially matching the gifts made by employees to eligible nonprofits.

- Volunteer grants. Similar to matching gift programs, these grants involve employers providing nonprofits with monetary gifts when their employees hit volunteer hours thresholds.

- Volunteer time off. Companies supply employees with a set number of hours to spend volunteering with nonprofits or schools. This Volunteer Time Off, or VTO, incentivizes staff to donate their time to mission-focused causes without missing out on their regular paycheck.

- Fundraising matches. In these programs, businesses contribute to or fully match the amount of money raised by an employee as part of a peer-to-peer fundraising campaign or other pledge-style campaign, like a walk-a-thon.

- Community grants. Businesses might directly offer grants to nonprofits, typically requiring these organizations to inquire about and apply for the programs as needed. These programs can be structured in a variety of ways, such as gifts simply disbursed from a business or as more official grants given through a business’s foundation or charitable arm.

- Annual giving campaigns. Companies might run their own annual fundraising drives, especially during the year-end season, to raise support for their nonprofit partners in the community.

- Automatic payroll deductions. Today’s payroll and HR tools make it easy for businesses to offer employees the opportunity to automatically donate a portion of their paychecks to eligible nonprofits.

- Annual grant stipends. These straightforward but uncommon programs give employees an annual stipend to be donated to nonprofits of their choice.

- Internal employee fundraising. Nonprofits can also look inward to ask for donations from their own employees and board members. This may take the form of a structured giving campaign or challenge or occur ad hoc, as with board members donating to a capital campaign.

- Scholarships. Many businesses offer financial support for private or higher education directly to students who apply for the programs. While nonprofits don’t directly benefit, education or youth organizations can help connect their constituents with these opportunities.

- Sponsorships. These structured agreements between nonprofits and businesses are often built around specific campaigns, programs, or events. They should be mutually beneficial, with the company receiving publicity and recognition in exchange for its support.

It’s unlikely your nonprofit will be able to jump right into pursuing all of these corporate giving options. Instead, a more helpful approach is to find an entry point and use it as a means of building relationships and strengthening ties with charitable businesses in your community.

Matching gift programs are by far the easiest way for nonprofits to begin intentionally growing their corporate giving revenue.

By securing matching gifts, volunteer grants, and fundraising matches from businesses, your nonprofit can establish a connection with the company’s employees and leverage those relationships to inquire about further opportunities.

If a business finds that many of its employees support the same local organizations and is interested in fostering employee engagement through philanthropy, it’s easy to make the case that new arrangements and giving programs would be mutually beneficial. Grants, annual workplace giving campaigns, and sponsorships can all flow from there.

The following steps will walk you through the process of establishing a thriving matching gift program that you can use as a springboard for further corporate giving opportunities.

2. Register your nonprofit with corporate giving vendors.

Most companies utilize third-party management companies to facilitate the behind-the-scenes aspects of their corporate giving programs. In order to maximize corporate giving efforts and direct more corporate dollars toward your cause, one of the first (and best) things you can do is make sure your organization is registered with these corporate giving vendors.

These platforms include (but are not limited to):

By creating free nonprofit accounts with these corporate giving providers and more, you enable donors to request eligible funding from their employers more easily, remove potential roadblocks, and allow your nonprofit to receive corporate support as quickly as possible. Not to mention, you can also increase your organization’s visibility as a verified cause!

3. Collect employment information from donors.

Donor employment status is one of the most important pieces of donor data you can collect. With this information on hand, you can not only better personalize your fundraising communications and estimate wealth levels, but you can also identify available corporate giving avenues to pursue.

That’s why it’s so important to prioritize the collection of employment information from your donors! You can do this in a few easy ways, too. For one, you can simply ask them! Consider incorporating an optional field in your donation form to request each individual’s employer name. However, some will opt not to provide the data point—at which you can look into other routes, such as email domain screening, employer appends services, and more.

From there, once you have access to your donors’ employment information, be sure to compare the data against some of the most well-known and charitable companies—including those with particularly generous matching gift programs—to locate valuable corporate giving opportunities.

4. Use a matching gift database to provide company guidelines.

Matching gifts are one of the most popular (meaning highly favored and widely available) forms of corporate giving revenue available to nonprofits. As a result, starting by targeting this funding source makes a great deal of sense. And one of the best ways to do so is to provide donors with easy access to their companies’ matching gift program guidelines using a matching gift database.

Luckily, tons of crowdfunding and nonprofit fundraising websites were developed with this functionality in mind—often by integrating with leading matching gift software solutions. This makes it quick and easy to incorporate corporate giving opportunities within the typical donor fundraising process, not to mention automatically direct supporters to their companies’ eligibility criteria and next steps.

All a donor has to do is conduct a quick search of their employer’s name in a provided online company database and select their company from the auto-completed suggestions. The tool then populates (typically on the donation confirmation page) with detailed and company-specific information on corporate giving qualifications, such as type of eligible employees and nonprofits, minimum and maximum donation amounts, submission deadlines, and more.

5. Follow up with eligible donors post-transaction.

After a donor submits their individual donation and exits your donation page (even without taking the suggested next steps to participate in their employers’ corporate giving opportunities), you still have a chance to re-engage the supporter.

Best practices recommend sending matching gift follow-up emails for this purpose within 24 hours of receiving the initial donation. However, you don’t want to send those messages too soon, either, as you may risk your matching gift email being discarded by the donor as a part of your donation receipt or confirmation.

Regardless, be sure to use this opportunity to remind donors about matching gift programs and encourage them to get involved. Here’s an example message a nonprofit might send:

“Thank you for your recent $200 donation, Becky! Find out if you can get your gift matched by your employer by searching the company name here. It typically takes less than five minutes and can help stretch your generous contribution further for our cause.”

You can even automate your organization’s matching gift follow-ups with the right tool! This allows you to engage each individual in a timely manner while ensuring no prospective matches slip through the cracks. In the end, you get more completed matches with less grunt work required of your team for follow-ups.

6. Mention corporate giving opportunities in fundraising appeals.

Fundraising research from Double the Donation reports that 84% of survey participants are more likely to donate if a matching gift is offered, while 1 in 3 donors even indicate they’d give a larger gift if matching is applied.

As a result, fundraising appeals that mention matching gifts see a 71% increase in response rate and a 51% increase in average donation amount. And that’s exactly why you want to highlight corporate giving opportunities like these within your donor asks!

It can be as simple as this: “Dear Jeffrey, did you know that a $50 gift can bring more than $100 of value for the furry friends in our animal shelter? Give today to see what your donation—and a match from your employer—can do!”

7. Communicate the benefits of corporate giving participation.

Donors love contributing to their favorite causes. This is especially true when they see the organizations they support doing a lot to make an impact on their missions.

For many donors, the increased impact is one of the most significant benefits of corporate giving. So when you make sure to communicate the impact that corporate giving programs have on your organization, you can drastically elevate your rates of corporate giving participation among donors.

For example, here’s an easy way to promote matching gifts to donors: “Thank you for your generous donation of $100! Did you know that your gift is eligible for a match from your employer, which would allow our team to provide supplies for twice as many families facing food insecurity?”

Main Takeaway

Corporate giving enables organizations to collect much-needed funding through strategic partnerships with mission-driven businesses.

If you’re looking to maximize corporate giving avenues—such as matching gifts, volunteer grants, team volunteerism, and more—incorporating the above best practices is a great way to start. Good luck!